- All Exams Instant Download

What is the probability of default of both the BHC and the investment bank? What is the probability of the BHC’s default provided both the investment bank and the retail bank survive?

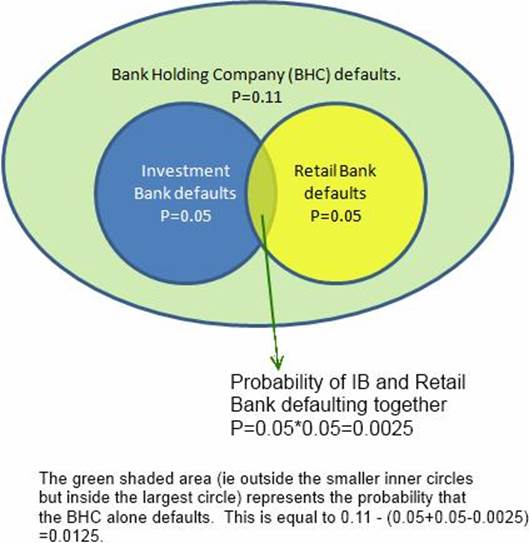

A Bank Holding Company (BHC) is invested in an investment bank and a retail bank. The BHC defaults for certain if either the investment bank or the retail bank defaults. However, the BHC can also default on its own without either the investment bank or the retail bank defaulting. The investment bank and the retail bank’s defaults are independent of each other, with a probability of default of 0.05 each. The BHC’s probability of default is 0.11.

What is the probability of default of both the BHC and the investment bank? What is the probability of the BHC’s default provided both the investment bank and the retail bank survive?

A . 0.0475 and 0.10

B . 0.11 and 0

C . 0.08 and 0.0475

D . 0.05 and 0.0125

Answer: D

Explanation:

Since the BHC always fails when the investment bank fails, the joint probability of default of the two is merely the probability of the investment bank failing, ie 0.05.

The probability of just the BHC failing, given that both the investment bank and the retail bank have survived will be equal to 0.11 – (0.05+0.05-0.05*0.05) = 0.0125. (The easiest way to understand this would be to consider a venn diagram, where the area under the largest circle is 0.11, and there are two intersecting circles inside this larger circle, each with an area of 0.05 and their intersection accounting for 0.05*0.05. We need to calculate the area outside of the two smaller circles, but within the larger circle representing the BHC).

Refer diagram below, please excuse the awful colors.

Latest 8008 Dumps Valid Version with 362 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund

Subscribe

Login

0 Comments

Inline Feedbacks

View all comments