- All Exams Instant Download

If the default correlation is 25%, what is the one year expected loss on this portfolio?

There are two bonds in a portfolio, each with a market value of $50m. The probability of default of the two bonds are 0.03 and 0.08 respectively, over a one year horizon.

If the default correlation is 25%, what is the one year expected loss on this portfolio?

A . $1.38m

B . $11m

C . $5.26m

D . $5.5mc

Answer: D

Explanation:

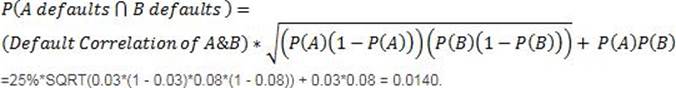

We will need to calculate the joint probability distribution of the portfolio as follows.Probability of the joint default of both A and B =

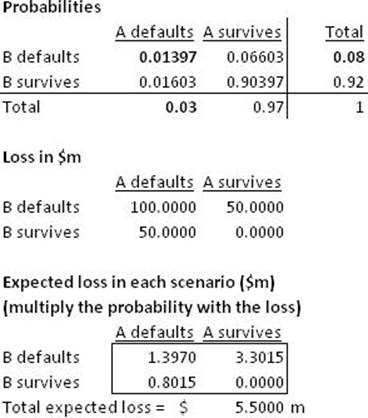

The marginal probabilities (ie the standalone probabilities of default of the two bonds) are known, and if we can calculate the probability of joint defaults of the two bonds, we can calculate the rest of the entries. We then multiply the probabilities with the expected loss under each scenario and add them up to get the total expected loss.

The calculations are shown below. The expected loss is $5.5m, and therefore the correct answer is Choice ‘d’.

Latest 8008 Dumps Valid Version with 362 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund

Subscribe

Login

0 Comments

Inline Feedbacks

View all comments