- All Exams Instant Download

If the probability of the two bonds defaulting simultaneously is 1.4%, what is the default correlation between the two?

There are two bonds in a portfolio, each with a market value of $50m. The probability of default of the two bonds are 0.03 and 0.08 respectively, over a one year horizon.

If the probability of the two bonds defaulting simultaneously is 1.4%, what is the default correlation between the two?

A . 0%

B . 100%

C . 40%

D . 25%

Answer: D

Explanation:

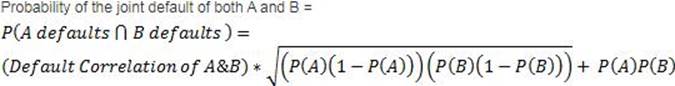

Probability of the joint default of both A and B =

We know all the numbers except default correlation, and we can solve for it. Default Correlation*SQRT(0.03*(1 – 0.03)*0.08*(1 – 0.08)) + 0.03*0.08 = 0.014. Solving, we get default correlation = 25%

Latest 8008 Dumps Valid Version with 362 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund

Subscribe

Login

0 Comments

Inline Feedbacks

View all comments