CIMA CIMAPRA19-F01-1-ENG F1 Financial Reporting (Online) Online Training

CIMA CIMAPRA19-F01-1-ENG Online Training

The questions for CIMAPRA19-F01-1-ENG were last updated at Feb 03,2026.

- Exam Code: CIMAPRA19-F01-1-ENG

- Exam Name: F1 Financial Reporting (Online)

- Certification Provider: CIMA

- Latest update: Feb 03,2026

LM is preparing its cash forecast for the next three months.

Which of the following items should be left out of its calculations?

- A . Tax payment due, that relates to last year’s profits.

- B . Receipt of a new bank loan raised for the purpose of purchasing new machinery.

- C . Expected loss on the disposal of a piece of land.

- D . Rental payment on a leased vehicle.

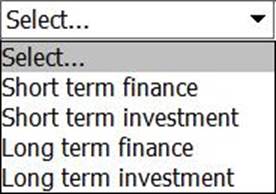

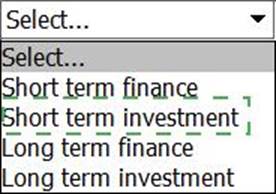

Which of the following is NOT a source of short-term finance?

- A . Increase in trade receivables

- B . Increase in trade payables

- C . Debt factoring

- D . Increase in a bank overdraft

CORRECT TEXT

KL has just completed their inventory count and has ascertained that the cost value of the

inventory is $460,000; this was made up of 10,000 units of component part FF.

A week before the year end the FF components were moved to a temporary warehouse.

Two weeks later they were inspected and found to have been damaged by the damp conditions in the temporary warehouse.

Of the 10,000 units 2,500 of them were damaged. After remedial work of $5.00 per unit KL anticipates they will be able to sell the damaged parts for $32.00 per unit.

What is the value for closing inventory to be included in the financial statements of KL?

Give your answer to the nearest $.

DE purchased an asset on 1 January 20X1 for $60,000 with a useful economic life of six years and a residual value of $3,000.

DE uses straight line depreciation for this asset.

On 31 December 20X3 the asset has a value in use of $ $28,000 and a fair value of $26,000.

Which of the following values should be used for the asset in DE’s statement of financial position as at 31 December 20X3?

- A . $28,000

- B . $26,000

- C . $30,000

- D . $31,500

Which of the following is a condition that has to be met for an entity to be exempt the requirement to prepare consolidated financial statements?

- A . The parent entity’s debt or equity instruments are not traded in a public market.

- B . The parent entity’s equity instruments are only traded in one country.

- C . The parent’s equity has a nominal value of less than $1 million.

- D . The parent’s net asset value is less than $1 million.

CORRECT TEXT

An asset cost $250,000 on 1 January 20X1 and on that date was assessed to have a residual value of $40,000 and a useful economic life of six years. On 1 January 20X4 management assessed that the remaining useful economic life of the asset was five years and that the asset had a residual value of nil.

What is the depreciation charge for this asset in the year ended 31 December 20X4?

Give your answer to the nearest whole number.

Latest CIMAPRA19-F01-1-ENG Dumps Valid Version with 177 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund