CIMA CIMAPRA17-BA3-1-ENG BA3 – Fundamentals of Financial Accounting (2017 SYLLABUS) (Online) Online Training

CIMA CIMAPRA17-BA3-1-ENG Online Training

The questions for CIMAPRA17-BA3-1-ENG were last updated at Apr 22,2024.

- Exam Code: CIMAPRA17-BA3-1-ENG

- Exam Name: BA3 - Fundamentals of Financial Accounting (2017 SYLLABUS) (Online)

- Certification Provider: CIMA

- Latest update: Apr 22,2024

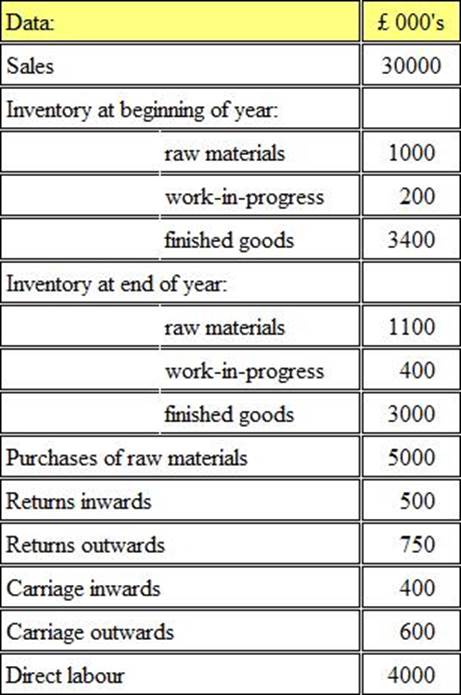

Refer to the Exhibit.

The following information relates to a business at its year end:

The prime cost of goods manufactured during the year is:

- A . £5,550,000

- B . £8,150,000

- C . £8,350,000

- D . £8,800,000

The balance on LMN’s cash account at 31 December 20X6 is $108,000 (debit) On performing the monthly bank reconciliation the following is discovered.

• a payment of $2,000 made to a supplier has not yet appeared on the bank statement,

• an automated receipt from a customer for $5,000 has not yet been recorded in the cash book, and

• a pigment to a supplier of $1,500 was incorrectly recorded in the cash book as $1,050

The balance showing on the bank statement at 31 December 20X6 is

- A . $111,450

- B . $101,450

- C . $114,550

- D . $104,550

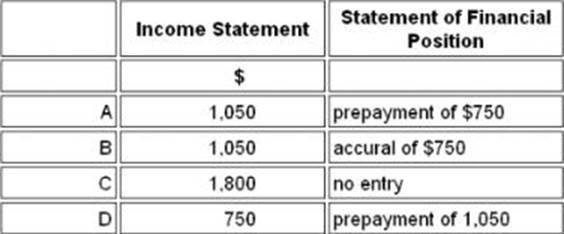

Refer to the Exhibit.

On 1 May year 1 a company pays insurance of $1,800 for the period to 30 April year 2.

What is the charge to the income statement and the entry in the statement of financial position for year 1 ended 30 November?

- A . A

- B . B

- C . C

- D . D

Which one of the following statements best describes the usefulness of the income statement account of a company:

- A . To evaluate its profitability over the past year

- B . To assess its potential profitability for the coming year

- C . To assess management performance over the past year

- D . To evaluate the return on capital employed

A company that is VAT-registered has sales for the period of $245,000 (excluding VAT) and purchases for the period of $123,375 (including VAT). The opening balance on the VAT account was $18,000 credit. The VAT rate is 17.5%.

What will be the closing balance on the VAT account at the end of the period?

- A . $6,500 debit

- B . $42,500 credit

- C . $375 debit

- D . $36,375 credit

A business has expanded rapidly during the current year. As a result the accounting records have been building up and the management accountant is having problems producing reports for each department head.

Which of the following would be the best solution if introduced?

- A . Extra working hours

- B . Accounting codes

- C . Prepare fewer reports

- D . Department head produce their own reports

Which of the following is not a book of prime entry?

- A . Purchases daybook

- B . Cash book

- C . Sales ledger

- D . Journal

At the end of the year, the non-current asset register showed assets with a net book value of £170,300. The non-current asset accounts in the nominal ledger showed a net book value of £150,300.

The difference could be due to a disposed asset not having been removed from the non-current asset register, which had.

- A . Disposal proceeds of £25,000 and a profit on disposal of £5,000

- B . Disposal proceeds of £25,000 and a net book value of £5,000

- C . Disposal proceeds of £25,000 and a loss on disposal of £5,000

- D . Disposal proceeds of £10,000 and a net book value of £10,000

Which of the following represent items of income for a business?

- A . Discount received, revenue & carriage outwards

- B . Revenue, bank interest & bad debts

- C . Discount allowed, bank interest & revenue

- D . Revenue, discount received & bank interest

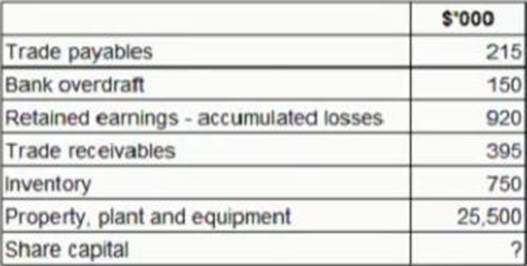

CORRECT TEXT

The balances of the trial balance of CDE for the year ended 31 May 20X4 is as follows

What must the balance on the share capital account be at 31 May 20X4 if the trial balance is to balance? Give your answer in $’000

![]()

Latest CIMAPRA17-BA3-1-ENG Dumps Valid Version with 393 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund