CIMA CIMAPRA17-BA2-1-ENG BA2 – Fundamentals of Management Accounting (2017 SYLLABUS) (Online) Online Training

CIMA CIMAPRA17-BA2-1-ENG Online Training

The questions for CIMAPRA17-BA2-1-ENG were last updated at Apr 22,2024.

- Exam Code: CIMAPRA17-BA2-1-ENG

- Exam Name: BA2 - Fundamentals of Management Accounting (2017 SYLLABUS) (Online)

- Certification Provider: CIMA

- Latest update: Apr 22,2024

CORRECT TEXT

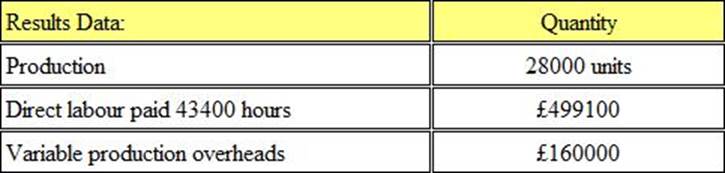

Refer to the exhibit.

Each unit of product ‘Smitten’ uses 5 kgs of material ‘Z’.

The budgeted details for March are as follows:

It is anticipated that sales of product ‘Smitten’ in March will be 20000 units.

The amount of material ‘Z’ that needs to be purchased in March is:

A company’s cash budgetary plans show that there will be surplus cash for three months of the forthcoming year.

Which THREE of the following would be appropriate management actions in this situation?

- A . Offer a longer credit period to new customers to boost sales

- B . Purchase new non-current assets to increase efficiency

- C . Reduce the finished goods inventory to save storage costs

- D . Pay suppliers early to obtain prompt payment discounts

- E . Repay a long-term loan to reduce interest costs

- F . Invest in a short-term deposit account

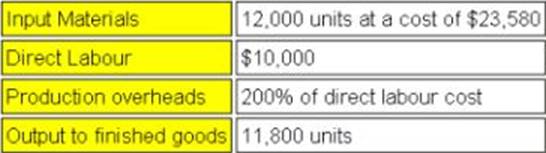

Refer to the Exhibit.

PD manufactures a product in a process operation. Normal loss is 5% of input and occurs at the end of the process.

The following data is available for the month of August:

Scrapped units have no value.

There was no opening or closing work in progress for August.

What is the value of the abnormal gain in August?

- A . Nil

- B . $1,880

- C . $1,816

- D . $893

In an integrated cost and financial accounting system, the accounting entries for the payment of net wages to indirect production workers would be:

- A . Debit: Bank accountCredit: Wages control account

- B . Debit: Work in progress control accountCredit: Bank account

- C . Debit: Wages control accountCredit: Bank account

- D . Debit: Production overhead control accountCredit: Bank account

A company uses an integrated accounting system.

The accounting entries for the sale of goods on credit would bE.

- A . Debit: Receivables control accountCredit: Sales account

- B . Debit: Sales accountCredit: Finished Goods Control account

- C . Debit: Receivables control accountCredit: Cost of sales account

- D . Debit: Sales accountCredit: Receivables control account

The materials price variance will be adverse when:

- A . The actual cost of the materials is more than the standard material cost for the output produced

- B . The actual cost of the materials purchased is more than the standard cost of the materials purchased

- C . The materials usage variance is favourable

- D . The price of materials has fallen

CORRECT TEXT

CVP Limited manufactures a single product with a selling price of $25.60. Fixed costs are $122,880 per month and the product has a profit/volume ratio of 40%.

In a month when actual sales were $358,400, CVP’s margin of safety in units was

A company operates an absorption costing system. Overheads are absorbed using a pre-determined absorption rate using labour hours. In the period actual labour hours were 10,600, 400 hours below budget. Actual overheads for the period were £234,680 and there was an under-absorption of overheads of £1,480.

What was the budgeted level of overheads?

- A . £242,000

- B . £233,200

- C . £245,072

- D . £224,720

The net present value (NPV) of an investment is as follows.

NPV at 14% = $6,320

NPV at 18% = ($4,600) negative

The internal rate of return (IRR) of the investment is closest to

- A . 14.6%

- B . 16.0%

- C . 16.3%

- D . 20.3%

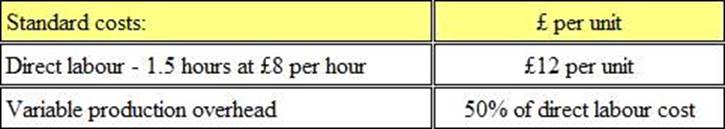

Refer to the Exhibit.

AM Ltd. makes and sells a single product for which the standard cost information is as follows:

✑ Budgeted production for the period is 30000 units.

✑ The actual results for the period were as follows:

What is the variable overhead expenditure variance?

- A . 13,161 adverse

- B . 13,161 favourable

- C . 13,600 adverse

- D . 13,600 favourable

Latest CIMAPRA17-BA2-1-ENG Dumps Valid Version with 392 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund