CIMA CIMAPRA19-F01-1-ENG F1 Financial Reporting (Online) Online Training

CIMA CIMAPRA19-F01-1-ENG Online Training

The questions for CIMAPRA19-F01-1-ENG were last updated at Feb 03,2026.

- Exam Code: CIMAPRA19-F01-1-ENG

- Exam Name: F1 Financial Reporting (Online)

- Certification Provider: CIMA

- Latest update: Feb 03,2026

CORRECT TEXT

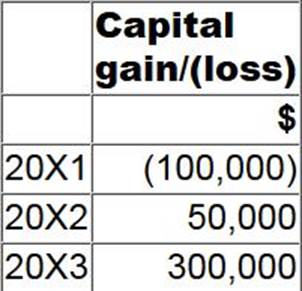

Country Q has the following rules in respect of capital tax on the disposal of assets:

* Capital gains are subject to tax at 25%.

* Capital losses can only be carried forward and offset against future capital gains.

The following data relates to ABC:

How much capital tax will be payable on the capital gain recorded in 20X3?

Give your answer to the nearest $.

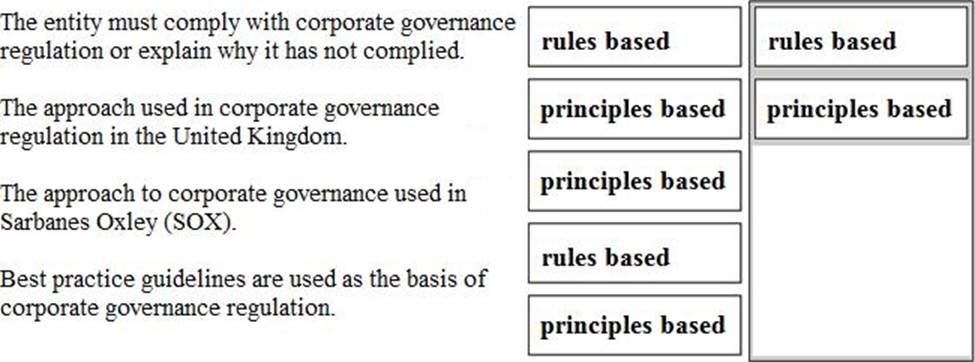

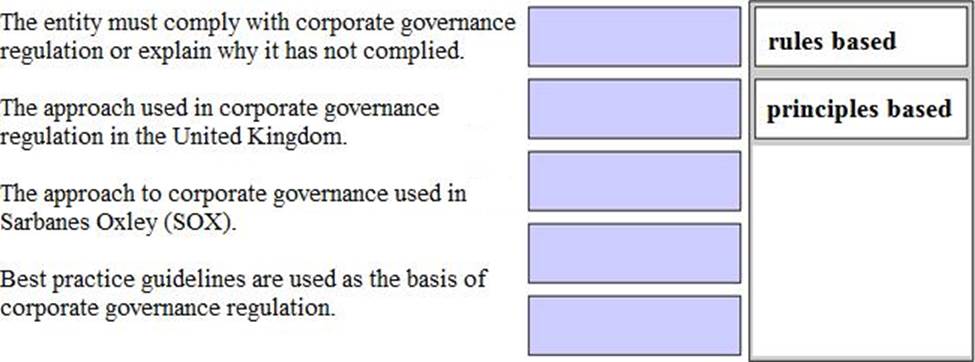

DRAG DROP

There are two main approaches that a country could adopt in respect of corporate governance regulation – a rules based approach and a principles based approach.

Match the following statements with the appropriate approach by placing either rules based or principles based against each of them.

ST has $20,000 of plant and machinery which was acquired on 1 April 20X0. Tax depreciation rates on plant and machinery are 20% reducing balance. All plant and machinery was sold for $12,000 on 1 April 20X2.

Calculate the tax balancing allowance or charge on disposal for the year ended 31 March 20X3 and state the effect on the taxable profit.

- A . A balancing allowance of $800 will increase taxable profits.

- B . A balancing allowance of $800 will reduce taxable profits.

- C . A balancing charge of $800 will increase taxable profits.

- D . A balancing charge of $800 will reduce taxable profits.

CORRECT TEXT

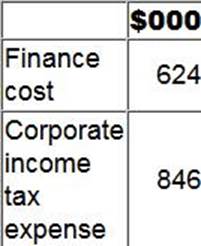

The following information is extracted from QQ’s statement of financial position at 31 March:

Included in other payables is interest payable of $80,000 at 31 March 20X2 and $73,000 at 31 March 20X1.

The following information if included within QQ’s statement of profit or loss for the year ended 31 March 20X2.

Included within finance cost is $124,000 which relates to interest paid on a finance lease.

QQ includes finance lease interest within financing activities on its statement of cash flows.

What cash outflow figure should be included as interest paid within the net cash flow from operating activities for QQ for the year ended 20X2?

Give your answer to the nearest $000.

CORRECT TEXT

An entity opens a new factory and receives a government grant of $25,000 towards the cost of new plant and equipment. This new plant and equipment originally costs $100,000.

The entity uses the net cost method allowed by IAS 20 Accounting for Government Grants

and Disclosure of Government Assistance to record government grants of this nature. All plant and equipment is depreciated at 20% a year on a straight line basis.

Calculate the amount of depreciation to be included for this plant and equipment in the statement of profit of loss for the factory’s first year of operation.

Give your answer to the nearest whole $.

CORRECT TEXT

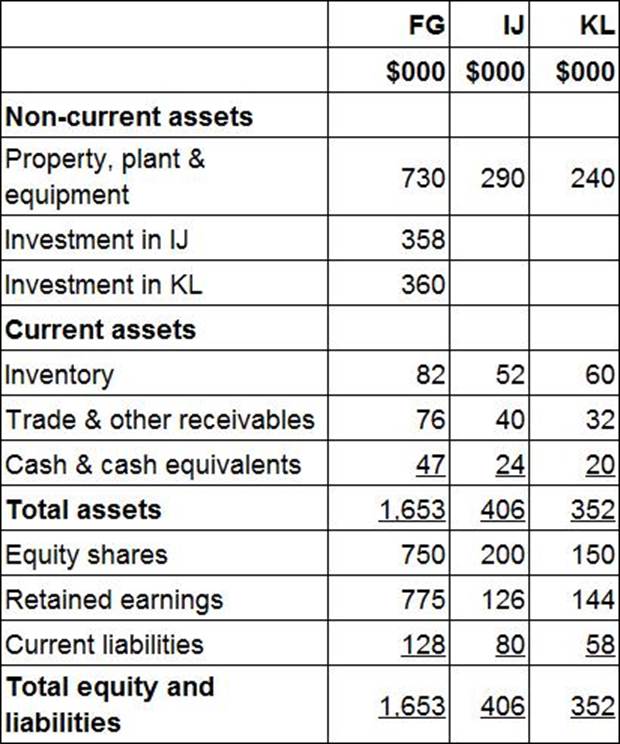

Statements of financial position for FG, IJ and KL at 31 December 20X5 include the following balances:

FG acquired 90% of IJ’s equity shares for $358,000 on 1 July 20X5 when IJ’s retained earnings were $98,000.

FG acquired 100% of KL’s equity shares for $360,000 on 1 January 20X5 when KL’s retained earnings were $155,000.

FG used the proportion of net assets method to value non-controlling interests at acquisition.

KL sold a piece of land to FG for $130,000 on 1 September 20X5. At the date of transfer the land had a carrying value of $50,000.

The management of FG expect KL to make profits in the future and no impairment ot its goodwill was proposed at 31 December 20X5.

Calculate the total goodwill to be included in FG’s consolidated statement of financial position as at 31 December 20X5.

Give your answer to the nearest whole $.

From the list below identify the item that appears in the statement of financial position.

- A . The amount of interest charged on loans during the year.

- B . The amount of loans outstanding at the year end.

- C . The amount of loans repaid during the year.

- D . The amount of interest actually paid during the year.

On 31 March 20X1 OP decided to sell a property. On that date this property was correctly classified as held for sale in accordance with IFRS 5 Non-Current Assets Held For Sale And Discontinued Operations.

In the draft financial statements of OP for the year ended 31 October 20X1 this property has been included at its fair value, which was $520,000 lower than its carrying value. This has resulted in a charge to profit or loss, the result of which is that the draft financial statements show a loss of $450,000 for the year to 31 October 20X1. When the management board of OP reviewed the draft financial statements it was unhappy about the loss and decided that the property should be reclassified as a non-current asset and reinstated to its original value, despite the fact that its plans for the property had not changed.

In accordance with the ethical principle of professional competence and due care, which THREE of the following statements explain how this property should be accounted for in the financial statements of OP for the year ended 31 October 20X1?

- A . The property should be treated as a non-current asset held for sale from 31 March 20X1.

- B . The property should be treated as a non-current asset held for sale from 1 November 20X1.

- C . The property should not be depreciated after 31 March 20X1.

- D . The impairment of $520,000 should be shown as an expense in the statement of profit or loss.

- E . The property should be depreciated until 31 October 20X1.

- F . The property impairment should not be recorded until the sale has completed.

DEF is considering introducing a Pay-As-You-Earn (PAYE) system but unsure of the advantages of using it.

Which of the following statements are advantages from the employees perspective of an entity using a PAYE system for collecting taxes from employees? Select ALL that apply.

- A . The employee will be able to deal with tax authority directly to make payments.

- B . The employee will avoid being charged penalties for paying late.

- C . The employee will calculate their own tax payment.

- D . The employee does not have to complete a self assessment tax return.

- E . The employee does not have to budget for their tax payments because the tax is deducted at source.

Latest CIMAPRA19-F01-1-ENG Dumps Valid Version with 177 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund