CIMA CIMAPRA19-F01-1-ENG F1 Financial Reporting (Online) Online Training

CIMA CIMAPRA19-F01-1-ENG Online Training

The questions for CIMAPRA19-F01-1-ENG were last updated at Feb 03,2026.

- Exam Code: CIMAPRA19-F01-1-ENG

- Exam Name: F1 Financial Reporting (Online)

- Certification Provider: CIMA

- Latest update: Feb 03,2026

Which THREE of the following must an auditor consider in order to form an opinion on the truth and fairness of an entity’s financial statements?

- A . Whether the entity has kept proper accounting records.

- B . Whether the entity has complied with the relevant legislator requirements in respect of the necessary disclosures.

- C . Whether all the information and explanations necessary for the purposes of the audit have been received.

- D . Whether every transaction that underpins the financial statements has been correctly

recorded. - E . Whether the entity has been exposed to any fraud.

CORRECT TEXT

The following information relates to AA.

Extract of Trial Balance at 31 December 20X4;

Notes

(i) Inventory at 31 December 20X4 was valued at cost at $30.

(ii) The loan which was received on 1 July 20X4 is repayable in 20X9.

(iii) Corporate income tax represents an over-provision of tax for the year ended 31 December 20X3. AA reported a loss for tax purposes for the year ended 31 December 20X4 and a tax refund is expected amounting to $20.

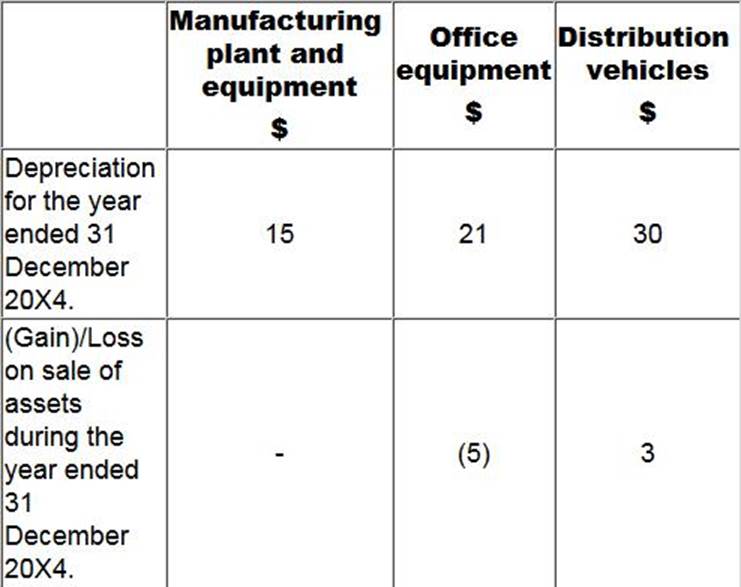

(iv) Cost of sales, administration and distribution costs need to be adjusted for the following:

Calculate gross profit for the year ended 31 December 20X4.

Give your answer as a whole $.

CORRECT TEXT

GH’s tax liability at 30 June 20X3 in respect of the tax charge on the profits for the year ended 30 June 20X3 is $876,000.

There was an over provision of $105,000 that related to the tax charge on the profits for the year ending 30 June 20X2.

What amount should be shown in GH’s statement of profit or loss for the year ending 30 June 20X3?

Give your answer to the nearest $.

CORRECT TEXT

GH’s tax liability at 30 June 20X3 in respect of the tax charge on the profits for the year ended 30 June 20X3 is $876,000.

There was an over provision of $105,000 that related to the tax charge on the profits for the year ending 30 June 20X2.

What amount should be shown in GH’s statement of profit or loss for the year ending 30 June 20X3?

Give your answer to the nearest $.

CORRECT TEXT

GH’s tax liability at 30 June 20X3 in respect of the tax charge on the profits for the year ended 30 June 20X3 is $876,000.

There was an over provision of $105,000 that related to the tax charge on the profits for the year ending 30 June 20X2.

What amount should be shown in GH’s statement of profit or loss for the year ending 30 June 20X3?

Give your answer to the nearest $.

CORRECT TEXT

GH’s tax liability at 30 June 20X3 in respect of the tax charge on the profits for the year ended 30 June 20X3 is $876,000.

There was an over provision of $105,000 that related to the tax charge on the profits for the year ending 30 June 20X2.

What amount should be shown in GH’s statement of profit or loss for the year ending 30 June 20X3?

Give your answer to the nearest $.

CORRECT TEXT

GH’s tax liability at 30 June 20X3 in respect of the tax charge on the profits for the year ended 30 June 20X3 is $876,000.

There was an over provision of $105,000 that related to the tax charge on the profits for the year ending 30 June 20X2.

What amount should be shown in GH’s statement of profit or loss for the year ending 30 June 20X3?

Give your answer to the nearest $.

PQ uses the fair value method for non-controlling interest at acquisition.

What is the revenue figure to be included in PQ’s consolidated statement of profit or loss for the year ended 31 December 20X0?

- A . $450,000

- B . $440,000

- C . $480,000

- D . $476,000

Which of the following would NOT be a risk or impact of overtrading?

- A . Increase in interest payments

- B . Increased borrowings

- C . Shortage of working capital

- D . Expanding too quickly

When developing local Generally Accepted Accounting Principles (known as local GAAP) some countries start with International Financial Reporting Standards (IFRSs) which are then amended to reflect local needs and conditions.

This type of approach is classified as:

- A . Adoption of IFRSs as local GAAP.

- B . Using IFRSs as a model for local GAAP.

- C . IFRSs having a persuasive influence in formulating local GAAP.

- D . IFRSs having little or no impact in formulating local GAAP.

Latest CIMAPRA19-F01-1-ENG Dumps Valid Version with 177 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund