- All Exams Instant Download

“The GIPS general provisions for real estate and for private equity require that both income and capital gains are included in the calculation and presentation of returns."

“The GIPS general provisions for real estate and for private equity require that both income and capital gains are included in the calculation and presentation of returns."

The capital return and income return for Monroe are closest to:

Capital return income return

A . 5.8% -2.6%

B . 5.8% 0.3%

C . 10.2% -2.6%

Answer: C

Explanation:

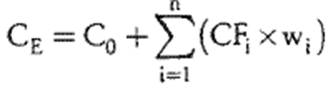

To obtain the capital and income return, we must first calculate the capital employed (CE), which utilizes the capital at the beginning of the period (CO), the capital contribution, and the capital disbursement. If the capital contribution came at 0.52 into the quarter, then the manager had use of those funds for 0.48 of the quarter. We weight the capital contribution of $2,300,000 by this portion.

If the capita! disbursement came at 0.74 into the quarter, then the manager lost use of these funds for 0.26 of the quarter. We weight the capital disbursement of $850,000 by 0.26 and subtract h as follows.

CE = $18,000,000 + $2,300,000(0.48) – $850,000(0.26) = $18,883,000

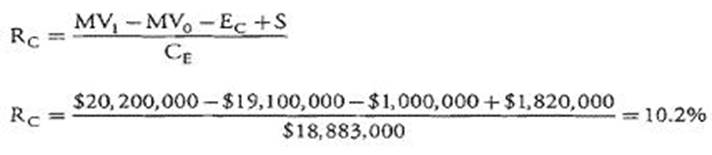

To determine the capital return (CC), we examine the capital gain or loss, capital expenditures, and sale of properties. Capital expenditures (EC) are those used for improving a property and are subtracted because they will be reflected in the property’s ending value and the manager should not receive credit for this additional value.

The proceeds from the sale of properties (S) are added in because the drop in ending property value from a sale should not be counted against a manager.

Using the provided figures:

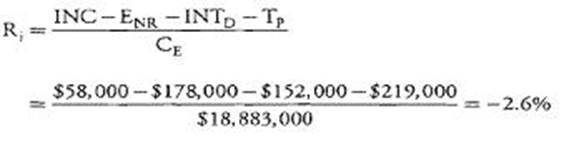

To determine the income return (Ri), we use the investment income (INC) minus the non-recoverable expenses (ENR) minus debt interest (INTD) minus property taxes (TP). Essentially we subtract the cost of doing business on a periodic basis from investment income as below.

The total return for the quarter is the sum of the capital return and the income return:

RT=RC + Ri = 10.2% – 2.6% = 7.6% (Study Session 18, LOS 49.p)

Latest CFA Level 3 Dumps Valid Version with 362 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund

Subscribe

Login

0 Comments

Inline Feedbacks

View all comments