- All Exams Instant Download

Matrix Corporation is a multidivisional company with operations in energy, telecommunications, and shipping. Matrix sponsors a traditional defined benefit pension plan. Plan assets are valued at $5.5 billion, while recent declines in interest rates have caused plan liabilities to balloon to $8.3 billion. Average employee age at Matrix is 57.5, which is considerably higher than the industry average, and the ratio of active to retired lives is 1.1. Joe Elliot, Matrix’s CFO, has made the following statement about the current state of the pension plan.

Matrix Corporation is a multidivisional company with operations in energy, telecommunications, and shipping. Matrix sponsors a traditional defined benefit pension plan. Plan assets are valued at $5.5 billion, while recent declines in interest rates have caused plan liabilities to balloon to $8.3 billion. Average employee age at Matrix is 57.5, which is considerably higher than the industry average, and the ratio of active to retired lives is 1.1. Joe Elliot, Matrix’s CFO, has made the following statement about the current state of the pension plan.

"Recent declines in interest rates have caused our pension liabilities to grow faster than ever experienced in our long history, but I am sure these low rates are temporary. I have looked at the charts and estimated the probability of higher interest rates at more than 90%. Given the expected improvement in interest rate levels, plan liabilities will again come back into line with our historical position. Our investment policy will therefore be to invest plan assets in aggressive equity securities. This investment exposure will bring our plan to an over-funded status, which will allow us to use pension income to bolster our profitability."

A. Critique Elliot’s statement with respect to investing Matrix’s plan assets by addressing the following three points:

B. Behavioral characteristic exhibited.ii. Plan risk and return objectives.iii. Using pension plan income to bolster firm profitability.

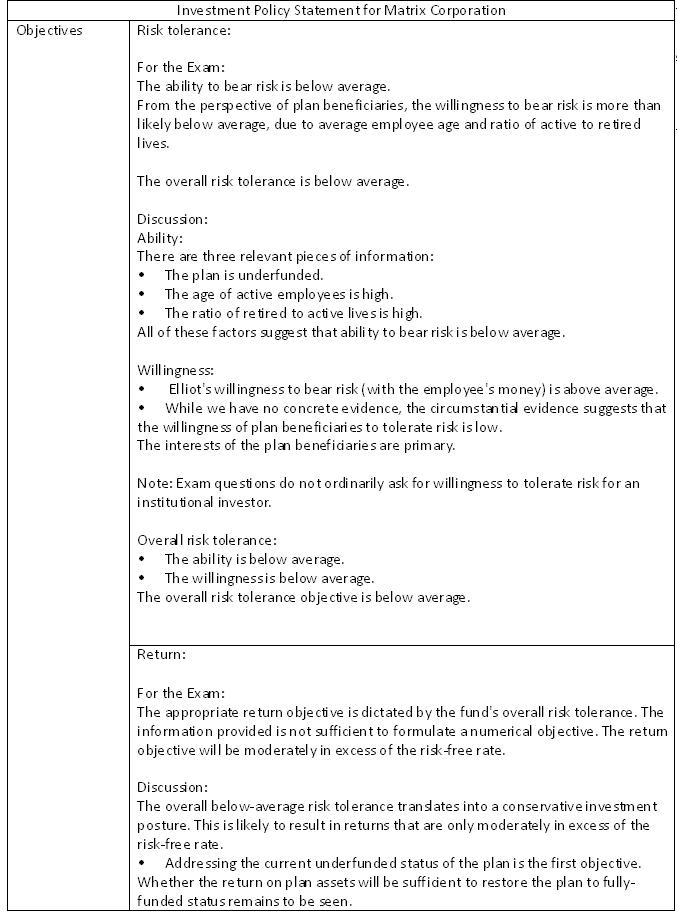

C. Based on the information provided, formulate a return objective and a risk objective for the Matrix Corporation pension plan. (No calculations required.)Template for Question 2-B

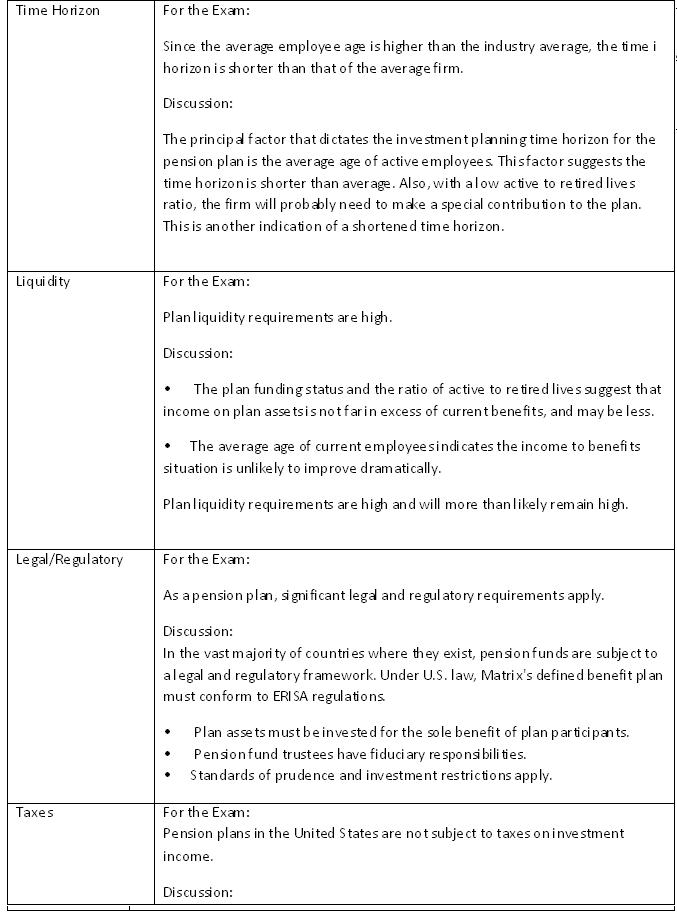

D. Based on the information provided, formulate an appropriate constraints section for the investment policy statement for the pension fund.Template for Question 2-C

Answer: A

Explanation:

i. For the Exam:

Elliot as exhibiting "overconfidence."

Discussion:

Elliot’s over reliance on his personal belief chat there is a high probability of interest rate increases ignores historical evidence chat interest rate changes are very difficult if not impossible to predict with that degree of accuracy. Elliot is more than likely overestimating the probability that his analysis will prove correct.

ii. For the Exam:

The return objectives are excessive, relative to the level of risk that is appropriate for the fund.

Discussion:

Elliot’s plan to solve the underfunded status of the plan by investing in high return securities is ill-advised. It requires the plan to invest in high-risk securities to obtain the high returns. Given the current plan funding status, retired to active lives ratio, and the demographic profile of the workforce, the plan’s ability to bear risk is below average-Also, Elliot is considering only the present value of the liabilities when interest races increase, where increasing rates can have a dampening effect on equity return. Hence, the return objectives are excessive relative to the level of risk chat is appropriate for the fund.

iii. For the Exam:

The investment of plan assets for the stated purpose of bolstering profitability is inappropriate, and may constitute a violation of Elliots fiduciary responsibilities und ERISA.

Discussion:

ERISA requires that pension plan assets be invested in the sole interest of plan beneficiaries. Failure to do so most likely constitutes a breach of fiduciary duty. Moreover, the financial implications of such an objective suggest an increase in the uncertainty about the future funding status of the plan. For both reasons, Elliot’s investment plan is inappropriate.

Template for Question 2-B

Template for Question 2-C

Latest CFA Level 3 Dumps Valid Version with 362 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund

Subscribe

Login

0 Comments

Inline Feedbacks

View all comments