- All Exams Instant Download

Jack Mercer and June Seagram are investment advisors for Northern Advisors. Mercer graduated from a prestigious university in London eight years ago, whereas Seagram is newly graduated from a mid-western university in the United States. Northern provides investment advice for pension funds, foundations, endowments, and trusts. As part of their services, they evaluate the performance of outside portfolio managers. They are currently scrutinizing the performance of several portfolio managers who work for the Thompson University endowment.

Jack Mercer and June Seagram are investment advisors for Northern Advisors. Mercer graduated from a prestigious university in London eight years ago, whereas Seagram is newly graduated from a mid-western university in the United States. Northern provides investment advice for pension funds, foundations, endowments, and trusts. As part of their services, they evaluate the performance of outside portfolio managers. They are currently scrutinizing the performance of several portfolio managers who work for the Thompson University endowment.

Over the most recent month, the record of the largest manager. Bison Management, is as follows. On March 1, the endowment account with Bison stood at $ 11,200,000. On March 16, the university contributed $4,000,000 that they received from a wealthy alumnus. After receiving that contribution, the account was valued at $ 17,800,000. On March 31, the account was valued at $16,100,000. Using this information, Mercer and Seagram calculated the time-weighted and money-weighted returns for Bison during March. Mercer states that the advantage of the time-weighted return is that it is easy to calculate and administer. Seagram states that the money-weighted return is, however, a better measure of the manager’s performance.

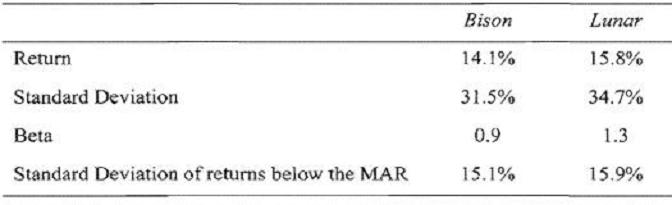

Mercer and Seagram are also evaluating the performance of Lunar Management. Risk and return data for the most recent fiscal year are shown below for both Bison and Lunar. The minimum acceptable return

(MAR) for Thompson is the 4.5% spending rate on the endowment, which the endowment has determined using a geometric spending rule. The T-bill return over the same fiscal year was 3.5%. The return on the MSCI World Index was used as the market index. The World index had a return of 9% in dollar terms with a standard deviation of 23% and a beta of 1.0.

The next day at lunch, Mercer and Seagram discuss alternatives for benchmarks in assessing the performance of managers. The alternatives discussed that day are manager universes, broad market indices, style indices, factor models, and custom benchmarks. Mercer states that manager universes have the advantage of being measurable but they are subject to survivor bias. Seagram states that manager universes possess only one quality of a valid benchmark.

Mercer and Seagram also provide investment advice for a hedge fund, Jaguar Investors. Jaguar specializes in exploiting mispricing in equities and over-the-counter derivatives in emerging markets. They periodically engage in providing foreign currency hedges to small firms in emerging markets when deemed profitable. This most commonly occurs when no other provider of these contracts is available to these firms. Jaguar is selling a large position in Mexican pesos in the spot market. Furthermore, they have just provided a forward contract to a firm in Russia that allows that firm to sell Swiss francs for Russian rubles in 90 days. Jaguar has also entered into a currency swap that allows a firm to receive Japanese yen in exchange for paying the Russian ruble.

The time-weighted and money-weighted returns for Bison during March (assuming compounding every half-month) are closest to:

Regarding their statements about time-weighted and money-weighted returns, determine whether Mercer and Seagram are correct or incorrect.

A . Only Mercer is correct.

B . Both are correct.

C . Neither is correct.

Answer: C

Explanation:

Mercer is incorrect, because alchough rime-weigh red return may be easy to calculate, it is not easy to administer. Accounts must be valued every time a significant cash inflow or outflow occurs. For most accounts this would mean daily valuations- Marking to market daily can be expensive to administer and potentially introduces more errors.

Seagram is incorrect because the money-weighted return is influenced by the timing of external cash flows, over which the manager may have no control. In this example, the manager received a cash flow in the middle of the month, Thus, the return during the second half of the month was weighted more heavily than the return during the first half of the month. The manager’s return during the first half of the month was quite impressive but the return during the second half of the month was negative. Consequently, the time-weighted return was 11.44% and money-weighced return was lower ar 6.8%. The money-weighted return penalizes the manager, because the contribution was not received until later in the month and the manager had no control over this. (Study Session 17, LOS 47.c)

Latest CFA Level 3 Dumps Valid Version with 362 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund

Subscribe

Login

0 Comments

Inline Feedbacks

View all comments