- All Exams Instant Download

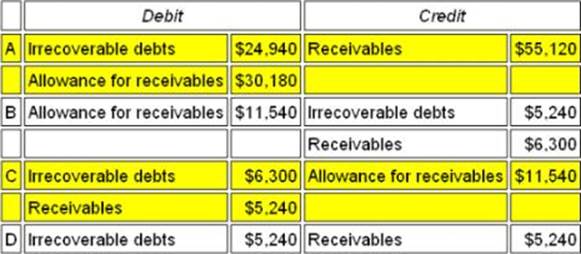

Which is the correct entry to be made to the accounts to record these transactions?

Refer to the Exhibit.

Soffit plc is calculating its irrecoverable debt charge and allowance for receivables for inclusion in its year-end accounts. Based on an aged receivables schedule, it is estimated that an allowance for receivables of $125,820 is required.

In addition, a specific allowance for receivables of $18,640 is also required for two customers who are experiencing cash flow difficulties. There are also two customers who have gone into receivership while owing the company $6,300. The current allowance for receivables is $156,000.

Which is the correct entry to be made to the accounts to record these transactions?

A . A

B . B

C . C

D . D

Answer: B

Latest CIMAPRA17-BA3-1-ENG Dumps Valid Version with 393 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund

Subscribe

Login

0 Comments

Inline Feedbacks

View all comments