- All Exams Instant Download

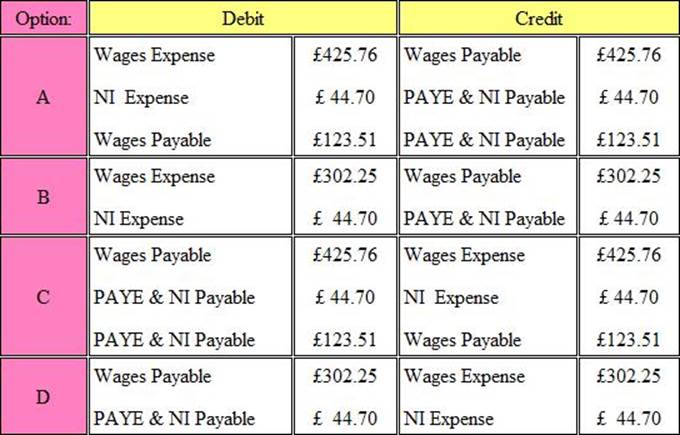

What are the correct ledger entries in the accounts of Kelt Ltd?

Refer to the Exhibit.

John, an employee of Kelt Ltd, earns gross wages for a week of £425.76.

Income tax is deducted at a rate of 25% on all earnings in excess of £85.00 per week and he is also liable to pay National Insurance contributions of 9% of his total earnings. Employers national insurance contributions are at a rate of 10.5%.

What are the correct ledger entries in the accounts of Kelt Ltd?

The answer is:

A . Option A

B . Option B

C . Option C

D . Option D

Answer: A

Latest CIMAPRA17-BA3-1-ENG Dumps Valid Version with 393 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund

Subscribe

Login

0 Comments

Inline Feedbacks

View all comments