- All Exams Instant Download

What was the most likely cause of the actuarial gain reported in the reconciliation of the projected benefit obligation for the year ended 2008?

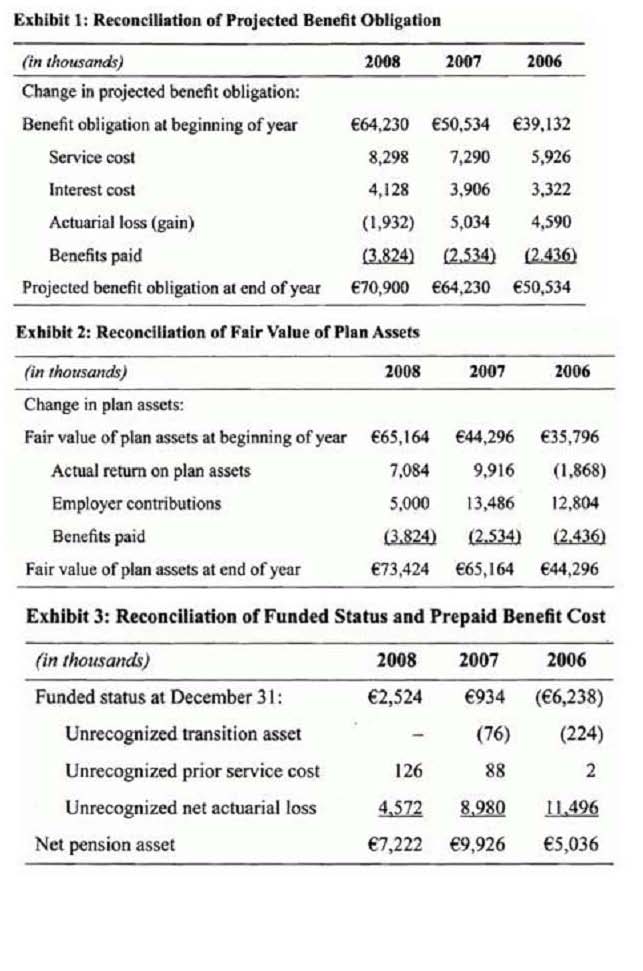

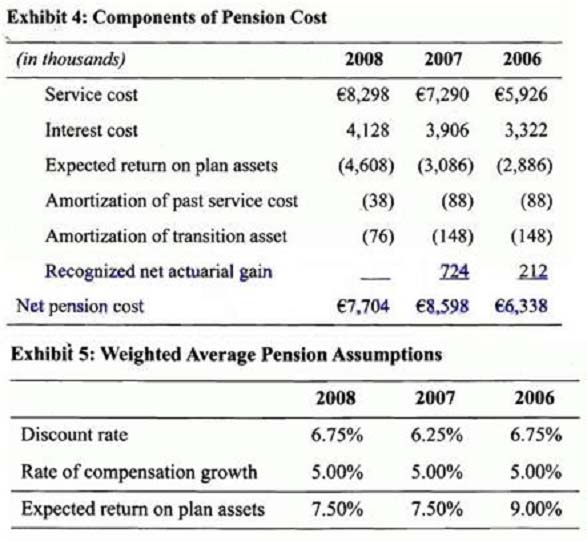

Stanley Bostwick, CFA, is a business services industry analyst with Mortonworld Financial. Currently, his attention is focused on the 2008 financial statements of Global Oilfield Supply, particularly the footnote disclosures related to the company’s employee benefit plans. Bostwick would like to adjust the financial statements to reflect the actual economic status of the pension plans and analyze the effect on the reported results of changes in assumptions the company used to estimate the projected benefit obligation (PBO) and net pension cost. But first, Bostwick must familiarize himself with the differences in the accounting for defined contribution and defined benefit pension plans.

Global Oilfield’s financial statements are prepared in accordance with International Financial Reporting Standards (IFRS). Excerpts from the company’s annual report are shown in the following exhibits.

What was the most likely cause of the actuarial gain reported in the reconciliation of the projected benefit obligation for the year ended 2008?

A . Increase in the average life expectancy of the participating employees.

B . Decrease in the expected rate of return.

C . Increase in the discount rate.

Answer: B

Explanation:

At rhe end of 2008, Global Oilfield reporred a net pension asset of 7,222 in accordance with IFRS. Under SFAS No. 158, Global Oilfields funded status of 2,524 should be reported on the balance sheet. Thus, it is necessary to reduce the net pension asset by 4,698 (7,222 as reported – 2,524 funded status). In order for the accounting equation to balance, it is also necessary to reduce equity by 4,698. (Study Session 6, LOS22.d)

Latest CFA Level 2 Dumps Valid Version with 713 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund

Subscribe

Login

0 Comments

Inline Feedbacks

View all comments