- All Exams Instant Download

The following information relates to DEF for the year ended 31 December 20X7:

The following information relates to DEF for the year ended 31 December 20X7:

• Property, plant and equipment has a carrying value of $3,500,000 and a tax written down value of $2,500,000.

• There are unused tax losses to carry forward of $1,250,000. These tax losses have arisendue topoor trading conditions which are not expected to improve in the foreseeable future.

• The corporate income tax rate is 25%.

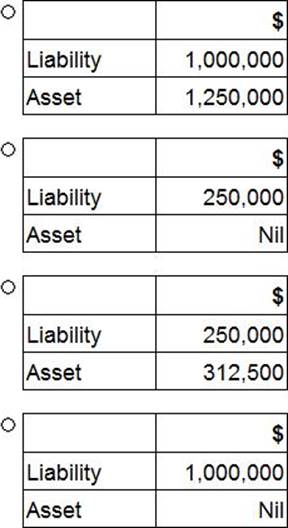

In accordance with IAS 12 Income Taxes, the financial statements of DEF for the year ended 31 December 20X7 would recognise deferred tax balances of:

A . Option A

B . Option B

C . Option C

D . Option D

Answer: A

Latest CIMAPRA19-F02-1-ENG Dumps Valid Version with 248 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund

Subscribe

Login

0 Comments

Inline Feedbacks

View all comments