What should you do?

Topic 4, Adtum Corp.

Case Study

This is a case study. Case studies are not timed separately. You can use as much exam time as you would like to complete each case. However, there may be additional case studies and sections on this exam. You must manage your time to ensure that you are able to complete all questions included on this exam in the time provided.

To answer the questions included in a case study, you will need to reference information that is provided in the case study. Case studies might contain exhibits and other resources that provide more information about the scenario that is described in the case study. Each question is independent of the other questions in this case study.

At the end of this case study, a review screen will appear. This screen allows you to review your answers and to make changes before you move to the next section of the exam. After you begin a new section, you cannot return to this section.

To start the case study

To display the first question in this case study, click the Next button. Use the buttons in the left pane to explore the content of the case study before you answer the questions. Clicking these buttons displays information such as business requirements, existing environment, and problem statements. If the case study has an All Information tab, note that the information displayed is identical to the information displayed on the subsequent tabs. When you are ready to answer a question, click the Question button to return to the question.

Travel and expense

The company is currently In Phase 2 of their Dynamics 365 finance Implementation.

• Consultants submit all travel receipts by using inter-office mail to the team admin for processing, but first Up Consultants wants to modernise this experience.

• Expense reports are manually approved and signed by the employee’s manager.

Finance

• First Up Consultants operates on a 4-5-4 calendar.

• Accounting, for revenue has been difficult with the SaaS offerings. This has led to implementing Dynamics 365 Finance Revenue recognition.

• Revenue recognition has been live for J months.

• Adatum Corporation pays Quarterly for use of the First Up Consultants web design

application, starting from the day of use

• Fourth Coffee pays monthly for use of the First Up Consultants photograph editing application, with a contract starting August I and payment starting September I.

• Adventure Works Cycles pays per use of the First Up Consultant video platform.

• A blocking rule is set up to prevent a sales order from processing if a customer exceeds a credit limit. – Customer credit is set up at the account level for VanArsdel, Ltd.

• Tailspin Toys is owned by Wingtip Toys. The companies have a credit limit of S60.000 and $100,000, respectively.

Tax

VAT tax recovery is required for eligible international business trip expenses. Bank reconciliation is manual and performed by using monthly mailed account statements.

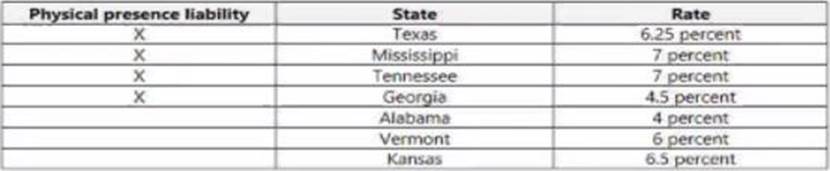

The company collects vales taxes from the following states:

Requirements

Travel and expense

• First Up Consultants requires that employees start using corporate cards for all travel expenses.

• All expenses over the require a receipt.

• Beer cannot be expensed

• Employees may use the corporate card for personal expenses during work travel, but expenses must be categories correctly.

• Client entertainment expenses totaling more than $250 must be audited.

• Employees require a mobile expense experience

• Expense report entries must be validated when a transaction Iine is entered.

• Employees require the ability to capture receipt* by using a mobile device.

• First Up Consultants requires the ability to reimburse employees in their paychecks for expenses incurred on personal cards.

Financial

• A virtual thirteenth month is required for year-end transactions.

• Each day. a validation file must go to First Up Consultants" bank detailing all vendor checks paid.

• Except fees, all matched transactions must clear automatically during bank reconciliation.

• The accounts payable team must verify expense reports prior to posting.

• Only payables are allowed to be posted to a poor period up to seven days into the new period

Issues

• User1 Installed the expense Management Service add-in and implemented the auto-match and create expense from receipt features, but the receipt images do not match the corporate card transactions

• Employee 1 submits an expense report for a business trip to Europe, but the report is not visible on the expense tax recovery page.

• Employees prowled feedback that the system lets them know of an expense report policy violation only after the entire expense report is submitted.

• Members of the finance department observe sales orders that posted into a closed period.

• The finance team observed that for sales order invoice 1234. the price incorrectly posts to a revenue account when it should be deferring.

• Fmployee2 purchased supplies for a holiday patty and needs to be reimbursed

• A customer orders software licenses for the offices in Tennessee and Alabama

• Expense reports for unapproved items are posting.

• VanArsdel. Ltd. exceeded its credit limit but the sales order was processed.

• Tailspin Toys purchase $70,000 in custom software development

You need to configure the system to meet the fiscal year requirements.

What should you do?

A . Add an additional period to ledger calendars.

B . Add an additional fiscal years

C . Divide the twelfth period.

D . Create a new fiscal calendar

E . Create a closing period

Answer: D

Latest MB-310 Dumps Valid Version with 151 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund