If the corporation has a weighted average cost of capital of 10%, which project should be selected?

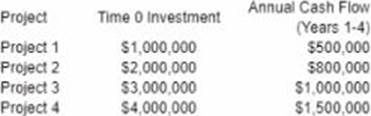

A corporation’s financial analyst has identified four potential protects that ate mutually exclusive. Each protect will produce a constant annual cash flow for years 1 through 4, and have an initial investment at time 0 shown below.

If the corporation has a weighted average cost of capital of 10%, which project should be selected?

A . Protect 1

B. Protect 2

C. Protect 3

D. Protect 4

Answer: D

Latest CMA Strategic Financial Management Dumps Valid Version with 112 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund

Subscribe

Login

0 Comments

Inline Feedbacks

View all comments