IMA CMA Strategic Financial Management CMA Part 2: Strategic Financial Management Exam Online Training

IMA CMA Strategic Financial Management Online Training

The questions for CMA Strategic Financial Management were last updated at Apr 25,2024.

- Exam Code: CMA Strategic Financial Management

- Exam Name: CMA Part 2: Strategic Financial Management Exam

- Certification Provider: IMA

- Latest update: Apr 25,2024

Javier makes hand-looted learner dog collars. The materials cost $10 per collar and the collars are sold for $50 each. Javier sells me collars at a local farmer’s market mat charges S100 per month for space rental if Javier’s income tax rate is 30%, how many collars must Javier sell each year to earn $1,000 net income?

- A . 29

- B . 53

- C . 66

- D . 263

A foreign subsidiary of a U S company has an intercompany loan from the parent company.

Which one of the following statements about the subsidiary’s functional currency is true?

- A . It should be the U S dollar if the local currency is hyper inflated

- B . It should be determined by the management of the U.S. Company

- C . It is the US dollar because the parent company is in the US

- D . It is the U S dollar because the subsidiary has an intercompany loan from the parent company

A company had an operating cycle of 110 days, a cash cycle of 40 days, and an accounts receivable period of so days. The company s inventory period and accounts payable period are

- A . inventory period = 50 days ana accounts payable period – 150 flays

- B . inventory period = 70 flays and accounts payable period = 50 flays

- C . inventory period = 10 days and accounts payable period = 50 days

- D . inventory period = 50 days and accounts payable period = 70 days

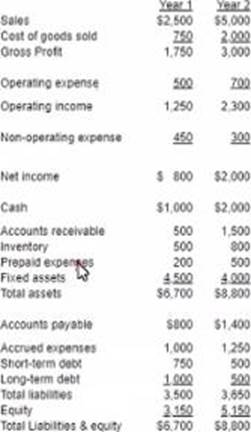

Below is the income statement and balance sheet for a retail corporation.

What is the corporation’s debt to total capital in year 2?

- A . 71%

- B . 41%

- C . 19%

- D . 6%

Genco Healthcare has asked ns controller to summarize the company’s financial performance for the past two years. The accountant provided the following two years financial ratios for reference.

- A . Less liquid mote profitable more solvent

- B . Less liquid mote profitable less solvent

- C . More Liquid Less profitable less solvent

- D . More liquid, less profitable mote solvent

Studler’s Restaurant is considering a contract to supply the weal senior citizen center with 10,000 meals. Regular sales at regular prices would be unaffected. The food cost for each meal s S3 Additional costs incurred as a result of the contract would De variable overhead of S 50 and variable selling general and administrative costs of S SO per meal sold. The selling price per meal would be $5, A total of $20,000 in fixed costs would be allocated at $2 per meal. The fixed costs are part of an overall total of $500,000 in annual fixed costs incurred regardless of the contract.

What will be the effect on pretax income if Studiers takes the special order?

- A . $10, 000 increase

- B . $10.000 decrease

- C . $20, 000 increase

- D . $20.000 decrease

Given the financial information shown below, what amounts would be shown for sales revenue and for gross prom, respectively in a common size income statement?

- A . 100% and 20%

- B . 100% and 45%

- C . 222% and 225$

- D . 100% and 55%

All of the following describe ethical leaders except

- A . dedicated leaders who can keep promises and commitment

- B . flexible leaders how new ethical behavior to be negotiable

- C . supportive leaders who encourage employees to adhere to company policy

- D . leaders who demonstrate high ethical standards

With respect to the COSO Enterprise Risk Management Integrated Framework (2017), which one of the following statements is true regarding Governance & Culture and Performance?

- A . They are both components of the Integrated Framework

- B . Governance & Culture is a principle and Performance is a component of the Integrated Framework

- C . They are both principles of the Integrated Framework

- D . Performance is a principle and Governance & Culture is a component of the Integrated Framework

Risk maps are used in companies’ enterprise risk management system because risk maps

- A . provide a quantitative tool that measures the probability of occurrence and the potential impact to calculate a potential loses

- B . rank risks.

Based on the potential loss that could occur it a risk were to materialize - C . are a generic set of risks for the company’s industry that can then be used as a foundation for further risk-identification techniques to specify the risks relevant for the company.

- D . compares the impact of a risk and the likelihood of occurrence to provide a qualitative assessment of the risk

Latest CMA Strategic Financial Management Dumps Valid Version with 112 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund