CORRECT TEXT

CORRECT TEXT

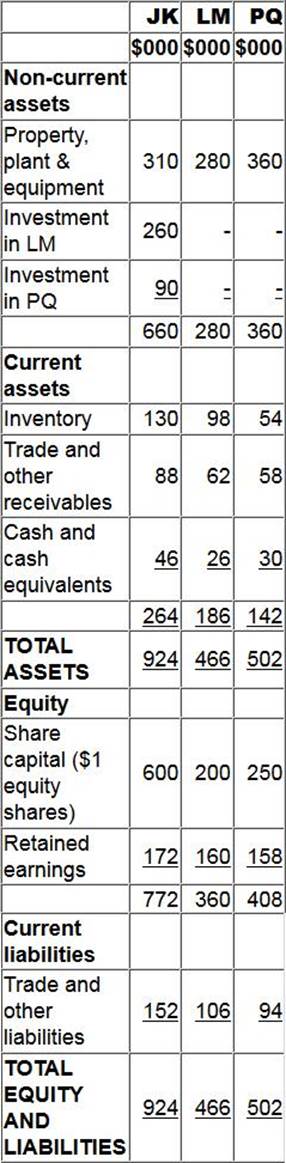

Statements of financial position as at 31 December 20X8 for JK, LM and PQ are as follows:

[1] JK purchased 80% of LM’s $1 equity shares on 1 January 20X8 for $260,000 when the retained earnings of JK were $110,000. At that date the non-controlling interest had a fair value of $63,000.

[2] JK purchased 25% of PQ’s $1 equity shares on 1 January 20X8 for $90,000 when the retained earnings of PQ were $96,000.

[3] During the year JK sold goods to LM for $32,000 at a mark up of 33.33% on cost. Half of the goods were still in LM’s inventory at 31 December 20X8.

[4] LM transferred $32,000 to JK on 30 December 20X8 in settlement of the inter-group trade. JK did not record the cash in its financial records until 2 January 20X9.

Calculate the goodwill arising on the acquisition LM.

Give your answer to the nearest $.

Answer: $13000

Latest CIMAPRA19-F01-1-ENG Dumps Valid Version with 177 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund