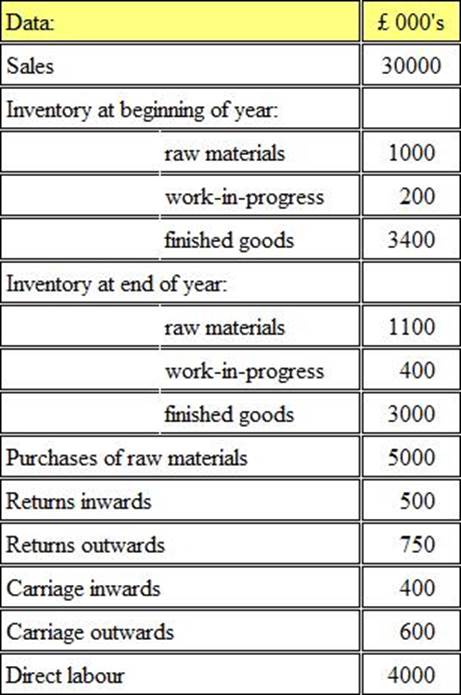

Refer to the Exhibit.

The following information relates to a business at its year end:

The prime cost of goods manufactured during the year is:

- A . £5,550,000

- B . £8,150,000

- C . £8,350,000

- D . £8,800,000

The balance on LMN’s cash account at 31 December 20X6 is $108,000 (debit) On performing the monthly bank reconciliation the following is discovered.

• a payment of $2,000 made to a supplier has not yet appeared on the bank statement,

• an automated receipt from a customer for $5,000 has not yet been recorded in the cash book, and

• a pigment to a supplier of $1,500 was incorrectly recorded in the cash book as $1,050

The balance showing on the bank statement at 31 December 20X6 is

- A . $111,450

- B . $101,450

- C . $114,550

- D . $104,550

Refer to the Exhibit.

On 1 May year 1 a company pays insurance of $1,800 for the period to 30 April year 2.

What is the charge to the income statement and the entry in the statement of financial position for year 1 ended 30 November?

- A . A

- B . B

- C . C

- D . D

Which one of the following statements best describes the usefulness of the income statement account of a company:

- A . To evaluate its profitability over the past year

- B . To assess its potential profitability for the coming year

- C . To assess management performance over the past year

- D . To evaluate the return on capital employed

A company that is VAT-registered has sales for the period of $245,000 (excluding VAT) and purchases for the period of $123,375 (including VAT). The opening balance on the VAT account was $18,000 credit. The VAT rate is 17.5%.

What will be the closing balance on the VAT account at the end of the period?

- A . $6,500 debit

- B . $42,500 credit

- C . $375 debit

- D . $36,375 credit

A business has expanded rapidly during the current year. As a result the accounting records have been building up and the management accountant is having problems producing reports for each department head.

Which of the following would be the best solution if introduced?

- A . Extra working hours

- B . Accounting codes

- C . Prepare fewer reports

- D . Department head produce their own reports

Which of the following is not a book of prime entry?

- A . Purchases daybook

- B . Cash book

- C . Sales ledger

- D . Journal

At the end of the year, the non-current asset register showed assets with a net book value of £170,300. The non-current asset accounts in the nominal ledger showed a net book value of £150,300.

The difference could be due to a disposed asset not having been removed from the non-current asset register, which had.

- A . Disposal proceeds of £25,000 and a profit on disposal of £5,000

- B . Disposal proceeds of £25,000 and a net book value of £5,000

- C . Disposal proceeds of £25,000 and a loss on disposal of £5,000

- D . Disposal proceeds of £10,000 and a net book value of £10,000

Which of the following represent items of income for a business?

- A . Discount received, revenue & carriage outwards

- B . Revenue, bank interest & bad debts

- C . Discount allowed, bank interest & revenue

- D . Revenue, discount received & bank interest

CORRECT TEXT

The balances of the trial balance of CDE for the year ended 31 May 20X4 is as follows

What must the balance on the share capital account be at 31 May 20X4 if the trial balance is to balance? Give your answer in $’000

CORRECT TEXT

The balances of the trial balance of CDE for the year ended 31 May 20X4 is as follows

What must the balance on the share capital account be at 31 May 20X4 if the trial balance is to balance? Give your answer in $’000

CORRECT TEXT

The balances of the trial balance of CDE for the year ended 31 May 20X4 is as follows

What must the balance on the share capital account be at 31 May 20X4 if the trial balance is to balance? Give your answer in $’000

CORRECT TEXT

The balances of the trial balance of CDE for the year ended 31 May 20X4 is as follows

What must the balance on the share capital account be at 31 May 20X4 if the trial balance is to balance? Give your answer in $’000

CORRECT TEXT

The balances of the trial balance of CDE for the year ended 31 May 20X4 is as follows

What must the balance on the share capital account be at 31 May 20X4 if the trial balance is to balance? Give your answer in $’000

AB sold a machine for $15,000 The machine had originally cost $160,000 and al the dale of disposal had a carrying value of $26,000.

The journal entry lo record this disposal is:

A)

B)

C)

D)

- A . Option A

- B . Option B

- C . Option C

- D . Option D

Different users have different needs from financial information. One of which is to assess how effectively management is performing and how much profit will be available to be distributed.

Which of the following users will have this need for information?

- A . Managers

- B . Suppliers

- C . Lenders

- D . Shareholders

CORRECT TEXT

A company has profit before tax and dividends of £500000. The share capital consists of 1000000 ordinary shares of £1 each and 100000 10% preference shares of 50p each.

A 10p dividend was declared on ordinary shares.

Assuming there was no tax liability for the period, profit retained for the period was

CORRECT TEXT

BCD has the following balances for the year ended 31 December 20X8:

What is the trade payables balance of BCD at 31 December 20X8? Give your answer to the nearest $"000.

CORRECT TEXT

STU has an accounting period end of 31 December 20X8 During the year STU paid $4,800 for business insurance to cover the year to 30 June 20X9 The amount paid for business insurance for 30 June 20X8 was $4,500.

What is the insurance expense to be recognized in the statement of profit or loss of STU for the year ended 31 December 20X8? Give your answer to the nearest $

CORRECT TEXT

Refer to the Exhibit.

Your organization uses the Weighted Average Cost method of valuing inventory.

During a particular month, the following inventory details were recorded:

The value of the inventory at the end of the month was

There are four separate but related bodies which control the setting of International accounting standards (IFRS’s).

Which THREE of the following are included in the standard setting process?

- A . International Accounting Standards Board (IASB)

- B . Accounting Standards Board (ASB)

- C . International Financial Reporting Interpretations Committee (IFRIC)

- D . Chartered Institute of Management Accountants (CIMA)

- E . Financial Accounting Standards Board (FASB)

- F . International Accounting Standards Committee Foundation (IASCF)

A company is preparing its accounts to 30 November. The latest gas bill received by the company was dated 30 September and included usage charges for the quarter 1 June to 31 August of $5,700 and a service charge of $1,200 for the quarter 1 October to 31 December. It is estimated that the gas bill for the following quarter will be a similar amount.

What will be the amount of the accrual shown in the accounts at 30 November 2006?

- A . $5,300

- B . $3,400

- C . $3,800

- D . $4,900

In a manufacturing company, prime costs is the total of

- A . Purchases of raw materials + opening inventories of raw materials – closing inventories of raw materials + direct wages + direct expenses + production overheads

- B . Purchases of raw materials + direct wages + direct expenses + production overheads

- C . Purchases of raw materials – opening inventories of raw materials + closing inventories

of raw materials + direct wages + direct expenses - D . Purchases of raw materials + opening inventories of raw materials – closing inventories of raw materials + direct wages + direct expenses

On 31 December 20X6 GHI makes a bonus issue of 50,000 shares On this dale the nominal value of the shares is $1 and the market value is $3 GHI has a share premium account with a substantial credit balance. The share capital account is credited correctly in the nominal ledger.

Which of the following statements is TRUE?

- A . The bonus issue is valued at $3 per share and the debit entry is to the cash account

- B . The bonus issue is valued at $1 per share and the debit entry is to the share premium account

- C . The bonus issue is valued at $1 per share and the debit entry is to the cash account

- D . The bonus issue is valued at $3 per share and the debit entry is to the share premium account

Mr UY has just had property P re-valued. Mr UY originally purchased property P for £560,000. It is now worth £780,000.

Which ONE of the following shows how this transaction should be recorded in Mr UY’s property account?

- A . £220,000 credit

- B . £220,000 debit

- C . £780,000 debit

- D . £780,000 credit

IAS 2 Inventories does not permit the use of the last in. first out (LIFO) method of valuing inventory In a time of rising prices, which of the following is a reason for this?

- A . Purchases are overstated

- B . Closing inventory is understated.

- C . Cost of sales are understated

- D . Gross profit is overstated

CORRECT TEXT

Refer to the Exhibit.

A company has the following transactions for an accounting period:

Closing inventory at the end of the period was $3,200 and gross profit was $16,400.

The opening inventory was therefore

Refer to the exhibit.

Both internal and external audits can be performed on the financial statements of a company. The results of the audits have different purposes and different reporting lines.

Which of the following combinations is correct?

- A . A

- B . B

- C . C

- D . D

Refer to the Exhibit.

A business banks its takings for the week. The bank account at the start of the week shows an overdraft

Which of the following is the dual effect?

- A . A

- B . B

- C . C

- D . D

“To assure shareholders that the stewardship of the organization was effectively carried out.”

What does this definition describe?

- A . Internal audit

- B . Preparation of financial statements

- C . External audit

- D . Reconciliation process

Refer to the Exhibit.

Transactions are often categorized between capital and revenue

Which of the following combinations are correct?

- A . A

- B . B

- C . C

- D . D

The record of how the profit or loss of a company has been allocated to distributions and reserves is found in the:

- A . Reserves account

- B . Appropriation account

- C . Capital account

- D . Retained profit account

Company X is a private limited oil company.

Which of the following are relevant for Company X’s integrated report?

- A . Risk of oil prices falling

- B . Risk of share prices falling

- C . Risk posed by competing oil companies and sustainable energy sources

- D . Need for report to be concise

CORRECT TEXT

The draft accounts of KenDoo Ltd for the year ended 31 August 2006 showed a net profit of $10000.

During the audit, the following errors and omissions were discovered.

(a) Items valued at $3100 had been completely omitted from the closing stock figure.

(b) Accrual of electricity bill for $200 and insurance prepayment of $500 had been omitted.

(c) Equipment costing $12000, acquired on 1 September 2005, had been debited to the purchases acccount. (KenDoo Ltd depreciates equipment at 15% on the straight line basis).

Due to materiality, the directors of KenDoo Ltd agreed to adjust the accounts accordingly.

Incorporating the above adjustments, the revised net profit is

CORRECT TEXT

ABC has the following summary of transactions for the quarter ended 30 June 20X9 ABC is registered for sales tax at 20%.

At the beginning of the quarter ABC owed $2,300 to the local tax authority.

What is the balance owing to the local tax authority at 30 June 20X97 Give your answer to the nearest dollar.

CORRECT TEXT

Refer to the exhibit.

The following is an extract from the trial balance of a business for its most recent year:

Net profit before tax has already been calculated as being £27m. Income tax of £5m is to be provided, and a final dividend of 30p per share is declared.

Using some or all of the figures above, the correct figure of retained profit for the year is

Refer to the exhibit.

A company has the following current assets and liabilities at its most recent year end:

When measured against standard acceptable levels for liquidity, the company can be said to have:

- A . An ideal acid test ratio, but a high current ratio

- B . An ideal current ratio, but a low acid test ratio

- C . A high current ratio and a low acid test ratio

- D . Ideal current and acid test ratios

The Framework is described as a conceptual framework when used in the creation of new accounting standards.

Which ONE of the following describes the approach of the Framework?

- A . Rules based

- B . Principles based

- C . Statutory

- D . Regulatory

CORRECT TEXT

GH has the following transactions for the week of January 20X8:

GH is not registered for sales tax

What is the total of the sales day book for this week? Give your answer to the nearest whole number:

Which one of the following best describes the stewardship function?

- A . Maximizing profits

- B . Ensuring the recording, controlling and safeguarding of assets

- C . Managing cash

- D . Carrying out an external audit

An audit trail is an essential part of an efficient, complete accounting system

Why is an audit trail important?

- A . To ensure all transactions are recorded

- B . To ensure all transactions are approved

- C . To ensure all transactions can be traced through the system

- D . To ensure all transactions can reported

An entity decides to revalue its freehold property during the current period creating a revaluation surplus.

Where in the current period financial statements would the revaluation surplus appear?

- A . Statement of financial position and statement of changes in equity

- B . Statement of changes in equity and statement of cash flow

- C . Statement of financial position and income statement

- D . Statement of changes in equity and income statement

Fraud can be conducted by employees or management. Management fraud can be hard to detect and may not seem like fraud at all as often company performance improves.

Which ONE of the following would be an example of management fraud?

- A . Theft by management

- B . Improved performance and position for the company

- C . Charging personal expenses to a company credit card

- D . Trading with friends and family

Refer to the Exhibit.

A company has the following chart of accounts:

The sales director of the northern region wants to know what the total sales of widgets are for the first quarter of the year.

Which code would he request for his report?

- A . 100

- B . 800

- C . 100800

- D . 800100

Refer to the Exhibit.

Which of the following items should be included in the valuation of inventory in a manufacturing company?

- A . A, C and F

- B . B, D and E

- C . A, C, D and E

- D . B, D, E and F

- E . A, C, D, E and F

- F . A, B, D, E and F

The valuation of inventory in a manufacturing company will consist of:

- A . Direct material and direct labor only

- B . Direct material, direct labor and direct expenses only

- C . All direct costs plus a share of production overheads

- D . All direct costs plus a share of production and non-production overheads

Fraud will only be prevented successfully if potential fraudsters perceive the risk of detection as high.

Which THREE of the following are ways to prevent fraud?

- A . Sufficient internal control systems

- B . Computerized accounting systems

- C . Continuous supervision of all employees

- D . Regular reconciliations

- E . Surprise audit visits

- F . Maintaining books of prime entry

The method of accounting that attempts to recognize changing price levels by applying an industry or asset specific price index to the cost of goods sold and assets consumed is known as:

- A . Current cost accounting

- B . Current purchasing power accounting

- C . Historic cost accounting

- D . Replacement cost accounting

Which ONE of the following is a possible explanation for a debit balance on the purchase ledger account of a supplier?

(i) An invoice has been posted twice

(ii) A credit note has been posted twice

(iii) A payment has been recorded against the wrong supplier account

(iv) A payment has been posted twice

(v) A contra was posted to the supplier account but not the customer account

(vi) Goods returned had been posted to the wrong supplier account

- A . (i) and (ii) only

- B . (iii) and (iv) only

- C . (i), (ii) and (iv) only

- D . (ii), (iii) and (iv) only

- E . (i), (ii) and (v) only

- F . (iii), (iv) and (vi) only

Accounting standards are needed so that financial statements will fairly and consistently describe financial performance.

What are accounting standards an example of?

- A . Principles based accounting

- B . Cash accounting

- C . Cost accounting

- D . Rules based accounting

Which ONE of the following does the Statement of Cash Flows show:

- A . The assets, equity and liabilities of a business

- B . The revenue and expenses of a business over a period of time

- C . The cash usage of a business over a period of time

- D . Notes to go with the statements that explain the practices used

An invoice to Sammy has been entered in the sales day book as $85 instead of $58.

To correct the position, which of the following procedures should be adopted?

- A . Debit Receivables $27, Credit Sales $27 and increase the balance owing by Sammy

- B . Debit Receivables $27, Credit Sales $27 and decrease the balance owing by Sammy

- C . Debit Sales $27, Credit Receivables $27 and increase the balance owing by Sammy

- D . Debit Sales $27, Credit Receivables $27 and decrease the balance owing by Sammy

Under the normal convention of accounting, assets are shown in the balance sheet at:

- A . Their current market value

- B . Their cost value

- C . The current cost to the firm of replacing them

- D . Their economic value to the firm

A trader commenced business with capital of $20,000. At the end of the financial year he had receivables of $10,000, payables of $6,000, inventory of $12,000, cash of $4,000 and non-current assets costing $16,000.

The profit/loss for the period was:

- A . $16,000 profit

- B . $16,000 loss

- C . $8,000 profit

- D . $8,000 loss

Which of the following transactions would be classified as a revenue transaction?

- A . Purchase of plant and machinery

- B . Issue of share capital

- C . Payments made to trade payables

- D . Purchase of inventory for resale

Which THREE of the following represent credit balances?

- A . assets

- B . liabilities

- C . income

- D . expenses

- E . capital

- F . drawings

Refer to the Exhibit.

A company is preparing its accounts to 30 April 2006. The latest telephone bill received by the company was dated 31 March and included call charges for the quarter 1 December to 28 February. The amount of the bill for call charges (excluding VAT) was $960. Most of the company’s telephone bills are for similar amounts.

Which of the following journal entries should be made to the company’s accounts at 30 April 2006?

The journal entries which should be made to the company’s accounts at 30 April 2006 is

- A . A

- B . B

- C . C

- D . D

Who is responsible for ensuring that internal control systems operate efficiently?

- A . External auditors

- B . Directors

- C . Shareholders of the company

- D . Creditors

Refer to the Exhibit.

Soffit plc is calculating its irrecoverable debt charge and allowance for receivables for inclusion in its year-end accounts. Based on an aged receivables schedule, it is estimated that an allowance for receivables of $125,820 is required.

In addition, a specific allowance for receivables of $18,640 is also required for two customers who are experiencing cash flow difficulties. There are also two customers who have gone into receivership while owing the company $6,300. The current allowance for receivables is $156,000.

Which is the correct entry to be made to the accounts to record these transactions?

- A . A

- B . B

- C . C

- D . D

The financial statements are produced in accordance with relevant accounting standards. This compliance ensures the requirement of fair presentation of transactions and events is met

How is this compliance emphasized?

- A . Reconciliation procedures

- B . Employment of qualified employees

- C . Specific disclosure

- D . Regular preparation of financial statements

A non-current asset was purchased for £240000 at the beginning of Year 1, with an expected life of 7 years and a residual value of £50000. It was depreciated by 20% per annum using the reducing balance method.

At the beginning of Year 4 it was sold for £100000.

The result of this was:

- A . A loss on disposal of £2720

- B . A loss on disposal of £22880

- C . A profit on disposal of £50000

- D . A profit on disposal of £58571

Which of the following would result in an increase in the cash balance for the period?

(a) A reduction in inventory

(b) A reduction in receivables

(c) A reduction in payables

(d) A gain on disposal of non-current assets

- A . (a) and (b) only

- B . (b) and (c) only

- C . (c) and (d) only

- D . (a), (b) and (c) only

Refer to the Exhibit.

A sole trader, who only has cash sales, banks all cash receipts above the agreed petty cash float of $400.

During week 2 he has the following transactions:

What is the amount banked at the end of week 2?

- A . $25

- B . $225

- C . $425

- D . $625

DRAG DROP

FGH has extracted its trial balance from its nominal ledger for the year ended 31 March 20X6. The items below have a value greater than SNil.

Which are debit and which are credit balances?

Refer to the Exhibit.

What is the correct ledger entry for purchase of goods on credit?

The answer is:

- A . Option A

- B . Option B

- C . Option C

- D . Option D

The purpose of the external audit is the examination of, and expression of opinion on the financial statements of an entity.

What is the purpose of internal audits?

- A . To prepare for external audits

- B . To assist employees of the organization in effective discharge of their responsibilities

- C . To create fear

- D . To confirm balances presented in the financial statements

Which one of the following book-keeping errors does not affect the view given by the financial accounts?

- A . An error of omission

- B . An error of commission

- C . An error of principle

- D . An error of original entry

A payment to a supplier has been credited to the supplier’s account and debited to the bank account.

This would result in

- A . an understatement of profit and an overstatement of liabilities

- B . an understatement of profit and an overstatement of assets

- C . an overstatement of profit and an overstatement of liabilities

- D . an overstatement of profit and an overstatement of assets

Which ONE of the following is an asset?

- A . Sales tax paid on an item

- B . Sales tax received from the sale of an item

- C . Sales tax exempt from an item

CORRECT TEXT

Refer to the Exhibit.

The following information is available relating to the non-current assets of Company X:

Non-current assets that had originally cost $225,000 and had a carrying value of $105,000 were sold during the year.

The figure for purchases of non-current assets to be shown in the statement of cash flows will be, to the nearest $1,000:

As well as independence other essential elements of internal audit can be identified.

Which THREE of the following would be classed as essential elements of internal audit?

- A . Due care

- B . Relationships

- C . Cost efficient

- D . Timely

- E . Evidence

- F . Efficient

Refer to the Exhibit.

The following information is given at a manufacturer’s year end:

Using some or all of the above figures, the correct figure for factory cost of goods completed is:

- A . £115,700

- B . £125,700

- C . £131,700

- D . £135,300

A company purchases a piece of machinery for $180,000. It is estimated that the machinery will produce 450,000 units over its useful life of 10 years. The residual value at the end of 10 years is nil. After eight years, the machine has produced 340,000 units and is sold for $30,000.

The profit/loss arising on disposal of the asset is

- A . $6,000 loss

- B . $14,000 loss

- C . $14,000 profit

- D . $6,000 profit

Cost of goods sold for a manufacturing company is the total of

- A . prime costs + production overheads + opening work in progress – closing work in progress + opening inventories of finished goods – closing inventories of finished goods

- B . prime costs + production overheads + opening inventories of raw materials – closing inventories of raw materials + opening work in progress – closing work in progress

- C . prime costs + production overheads – opening work in progress + closing work in progress – opening inventories of finished goods + closing inventories of finished goods

- D . prime costs + production overheads + opening inventories of raw materials – closing inventories of raw materials + opening work in progress – closing work in progress + opening inventories of finished goods – closing inventories of finished goods

CORRECT TEXT

Refer to the Exhibit.

A company operates an AVCO system of inventory. Opening inventory at the beginning of the period was 400 units @ $6.50 per unit.

During the period, the following purchases and issues were recorded:

The amount charged to the company’s income statement in the period is

Refer to the Exhibit.

John, an employee of Kelt Ltd, earns gross wages for a week of £425.76.

Income tax is deducted at a rate of 25% on all earnings in excess of £85.00 per week and he is also liable to pay National Insurance contributions of 9% of his total earnings. Employers national insurance contributions are at a rate of 10.5%.

What are the correct ledger entries in the accounts of Kelt Ltd?

The answer is:

- A . Option A

- B . Option B

- C . Option C

- D . Option D

DEF prepares its financial statements to 30 September each year On 1 March 20X5 DEF acquires an office and immediately rents it to a tenant charging $2,400 a quarter payable in advance.

The tenant pays $2,400 on each of the following days 1 March 20X5, 6 June 20X5, 4 September 20X5 and 1 December 20X5.

What is the liability reported in the statement of financial position relating to the rent at 30 September 20X5?

- A . $7,200

- B . $1,600

- C . $4,000

- D . $5,600

Before lending to an entity, which TWO of the following pieces of information would a potential lender want to consider?

- A . Past tax payments made by the entity

- B . Social policies of the entity

- C . Dividend policy of the entity

- D . Ability of the entity to meet interest payments

- E . Long term business plans of the entity

A company which is VAT-registered receives an invoice for goods purchased for resale totaling $2,585 from a supplier that is not VAT-registered. VAT is at the rate of 17.5%.

The correct entry to record the invoice is:

A)

B)

C)

D)

- A . Exhibit A

- B . Exhibit B

- C . Exhibit C

- D . Exhibit D

Which of the following transactions would be classified as a capital transaction?

- A . Depreciation on plant and machinery

- B . Expenditure on heat and light

- C . Repayment of bank loan

- D . Payment of dividends

Refer to the Exhibit.

Which of the following balances normally result from the double-entry system of book-keeping?

The answer is:

- A . Option A

- B . Option B

- C . Option C

- D . Option D

Refer to the Exhibit.

What is the wages expense for the income statement for month 1?

- A . $3,808

- B . $4,428

- C . $6,236

- D . $6,966

If the royalty cost falls on items used in the manufacturing process, which TWO of the following would be true?

- A . Prime cost increases

- B . Factory cost of production reduces.

- C . Factory cost of goods completed remains the same

- D . Factory cost of production increases

- E . Prime cost reduces