PRMIA 8010 Operational Risk Manager (ORM) Exam Online Training

PRMIA 8010 Online Training

The questions for 8010 were last updated at Feb 26,2026.

- Exam Code: 8010

- Exam Name: Operational Risk Manager (ORM) Exam

- Certification Provider: PRMIA

- Latest update: Feb 26,2026

A bank’s detailed portfolio data on positions held in a particular security across the bank does not agree with the aggregate total position for that security for the bank .

What data quality attribute is missing in this situation?

- A . Data completeness

- B . Data integrity

- C . Auditability

- D . Data extensibility

A bank’s detailed portfolio data on positions held in a particular security across the bank does not agree with the aggregate total position for that security for the bank .

What data quality attribute is missing in this situation?

- A . Data completeness

- B . Data integrity

- C . Auditability

- D . Data extensibility

A bank’s detailed portfolio data on positions held in a particular security across the bank does not agree with the aggregate total position for that security for the bank .

What data quality attribute is missing in this situation?

- A . Data completeness

- B . Data integrity

- C . Auditability

- D . Data extensibility

A bank’s detailed portfolio data on positions held in a particular security across the bank does not agree with the aggregate total position for that security for the bank .

What data quality attribute is missing in this situation?

- A . Data completeness

- B . Data integrity

- C . Auditability

- D . Data extensibility

A bank’s detailed portfolio data on positions held in a particular security across the bank does not agree with the aggregate total position for that security for the bank .

What data quality attribute is missing in this situation?

- A . Data completeness

- B . Data integrity

- C . Auditability

- D . Data extensibility

A bank’s detailed portfolio data on positions held in a particular security across the bank does not agree with the aggregate total position for that security for the bank .

What data quality attribute is missing in this situation?

- A . Data completeness

- B . Data integrity

- C . Auditability

- D . Data extensibility

A bank’s detailed portfolio data on positions held in a particular security across the bank does not agree with the aggregate total position for that security for the bank .

What data quality attribute is missing in this situation?

- A . Data completeness

- B . Data integrity

- C . Auditability

- D . Data extensibility

Loss provisioning is intended to cover:

- A . Unexpected losses

- B . Losses in excessof unexpected losses

- C . Both expected and unexpected losses

- D . Expected losses

For a hypotherical UoM, the number of losses in two non-overlapping datasets is 24 and 32 respectively. The Pareto tail parameters for the two datasets calculated using the maximum likelihood estimation method are 2 and 3 .

What is an estimate of the tail parameter of the combined dataset?

- A . 2.57

- B . 2.23

- C . 3

- D . Cannot be determined

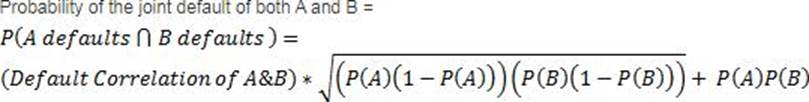

There are two bonds in a portfolio, each with a market value of $50m. The probability of default of the two bonds are 0.03 and 0.08 respectively, over a one year horizon.

If the probability of the two bonds defaulting simultaneously is 1.4%, what is the default correlation between the two?

- A . 0%

- B . 100%

- C . 40%

- D . 25%

Latest 8010 Dumps Valid Version with 240 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund