PRMIA 8010 Operational Risk Manager (ORM) Exam Online Training

PRMIA 8010 Online Training

The questions for 8010 were last updated at Feb 26,2026.

- Exam Code: 8010

- Exam Name: Operational Risk Manager (ORM) Exam

- Certification Provider: PRMIA

- Latest update: Feb 26,2026

If F be the face value of a firm’s debt, V the value of its assets and E the market value of equity, then according to the option pricing approach a default on debt occurs when:

- A . F > V

- B . V < E

- C . F < V

- D . F – E < V

If F be the face value of a firm’s debt, V the value of its assets and E the market value of equity, then according to the option pricing approach a default on debt occurs when:

- A . F > V

- B . V < E

- C . F < V

- D . F – E < V

If F be the face value of a firm’s debt, V the value of its assets and E the market value of equity, then according to the option pricing approach a default on debt occurs when:

- A . F > V

- B . V < E

- C . F < V

- D . F – E < V

Which of the following is the best description of the spread premium puzzle:

- A . The spread premium puzzle refers to observed default rates being much less than implied default rates, leading to lower credit bonds being relatively cheap when compared to their actual default probabilities

- B . The spread premium puzzle refers to dollar denominated non-US sovereign bonds being priced a at significant discount to other similar USD denominated assets

- C . The spread premium puzzle refers to AAA corporate bonds being priced at almost the same prices as equivalent treasury bonds without offering the same liquidity or guarantee as treasury bonds

- D . The spread premium puzzle refers to the moral hazard implicit in the monoline insurance market

Which of the following situations are not suitable for applying parametric VaR:

I. Where the portfolio’s valuation is linearly dependent upon risk factors

II. Where the portfolio consists of non-linear products such as options and large moves are involved

III. Where the returns of risk factors are known to be not normally distributed

- A . I and II

- B . II and III

- C . I and III

- D . All of the above

A corporate bond maturing in 1 year yields 8.5% per year,while a similar treasury bond yields 4% .

What is the probability of default for the corporate bond assuming the recovery rate is zero?

- A . 4.15%

- B . 4.50%

- C . 8.50%

- D . Cannot be determined from the given information

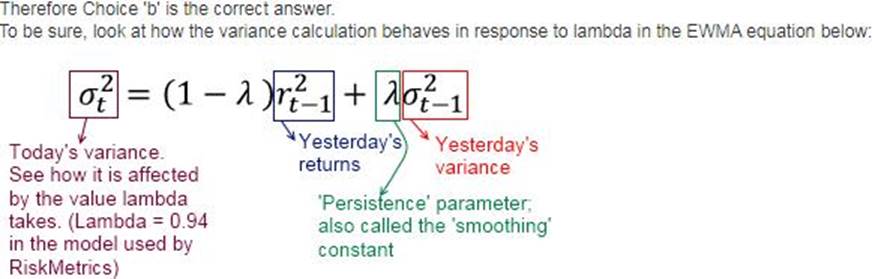

As the persistence parameter under EWMA is lowered, which of the following would be true:

- A . The model will react slower to market shocks

- B . The model will react faster to market shocks

- C . High variance from the recent past will persist for longer

- D . The model will give lower weight to recent returns

What is the risk horizon period used for credit risk as generally used for economic capital calculations and as required by regulation?

- A . 1-day

- B . 1 year

- C . 10 years

- D . 10 days

A key problem with return on equity as a measure of comparative performance is:

- A . that return on equity is not adjusted for risk

- B . that return on equity are not adjusted for cash flows being different from accounting earnings

- C . that return on equity measures do not account for interest and taxes

- D . that return on equity ignores the effect of leverage on returns to shareholders

CORRECT TEXT

Which of the following statements are true in relation to Historical Simulation VaR?

I. Historical Simulation VaR assumes returns are normally distributed but have fat tails

II. It uses full revaluation, as opposed to delta or delta-gamma approximations

III. Acorrelation matrix is constructed using historical scenarios

IV. It particularly suits new products that may not have a long time series of historical data available

- A . II

- B . II and III

- C . I and IV

- D . All of the above

Latest 8010 Dumps Valid Version with 240 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund