PRMIA 8010 Operational Risk Manager (ORM) Exam Online Training

PRMIA 8010 Online Training

The questions for 8010 were last updated at Feb 27,2026.

- Exam Code: 8010

- Exam Name: Operational Risk Manager (ORM) Exam

- Certification Provider: PRMIA

- Latest update: Feb 27,2026

Which of the following credit risk models relies upon theanalysis of credit rating migrations to assess credit risk?

- A . KMV’s EDF based approach

- B . The CreditMetrics approach

- C . The actuarial approach

- D . The contingent claims approach

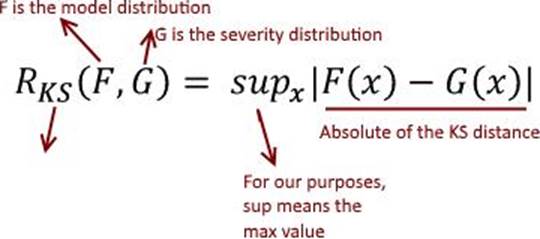

Which of the following is closest to the description of a ‘risk functional’?

- A . A risk functional is the distribution thatmodels the severity of a risk

- B . A risk functional is a model distribution that is an approximation of the true loss distribution of a risk

- C . Risk functional refers to the Kolmogorov-Smirnov distance

- D . A risk functional assigns a penalty value for the difference between a model distribution and a risk’s severity distribution

A bullet bond and an amortizing loan are issued at the same time with the same maturity and with the same principal .

Which of these would have a greater credit exposure halfway through their life?

- A . Indeterminate with the given information

- B . They would have identical exposure half way through their lives

- C . The amortizing loan

- D . The bullet bond

Which of the following are ordered correctly in the order of debt seniority in a bankruptcy situation?

I. Equity, Subordinate debt, Senior debt

II. Senior debt, Preferred stock, Equity

III. Secured debt, Accounts payable, Preferred stock

IV. Secured debt, DIP financing, Equity

- A . II and III

- B . I and IV

- C . I

- D . II, III and IV

Which of the following is the most accurate description of EPE (Expected Positive Exposure):

- A . The maximum average credit exposure over a period of time

- B . The price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date

- C . Weighted average of the future positive expected exposure across a time horizon.

- D . The average of the distribution of positive exposures at a specified future date

The probability of default of a security over a 1 year period is 3% .

What is the probability that it would not have defaulted at theend of four years from now?

- A . 11.47%

- B . 88.53%

- C . 12.00%

- D . 88.00%

Which of the following cannot be used as an internal credit rating model to assess an individual borrower:

- A . Distance to default model

- B . Probit model

- C . Logit model

- D . Altman’s Z-score

Which of the following carry greater counterparty risk: a forward contract on a 10 year note, or a commercial paper carrying a AA credit rating with identical maturity and notional?

- A . The forward contract has greater credit risk as its future gains are unknown

- B . Credit risk can not be compared in these terms

- C . They both carry the same credit risk

- D . The commercial paper has greater credit risk as the entire notional is outstanding

If the cumulative default probabilities of default for years 1 and 2 for a portfolio of credit risky assets is 5% and 15% respectively, what is the marginal probability of default in year 2 alone?

- A . 15.79%

- B . 10.53%

- C . 10.00%

- D . 11.76%

For a loan portfolio, unexpected losses are charged against:

- A . Credit reserves

- B . Economic credit capital

- C . Economic capital

- D . Regulatory capital

Latest 8010 Dumps Valid Version with 240 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund