IMA CMA Strategic Financial Management CMA Part 2: Strategic Financial Management Exam Online Training

IMA CMA Strategic Financial Management Online Training

The questions for CMA Strategic Financial Management were last updated at Jul 19,2025.

- Exam Code: CMA Strategic Financial Management

- Exam Name: CMA Part 2: Strategic Financial Management Exam

- Certification Provider: IMA

- Latest update: Jul 19,2025

Radal inc. currently has three product lines: stationery computer supplies, and printer cartridges.

Based on the following information, the company is considering whether to drop the printer cartridge line.

- A . continue the printer cartridge product line to avoid an additional $3.000 decrease in net income

- B . drop the printer cartridge product line as this will result in a $3 000 increase m net income

- C . drop the printer cartridge product line as this will result in a $6,000 increase m net income

- D . continue the printer cartridge product line to avoid an additional $6.000 decrease in net income

When evaluating a capital Budgeting proposal, an advantage of using the payback method is that Bits process

- A . assesses the liquidity of the project.

- B . considers the time value of money.

- C . incorporates all of the project’s cash inflows and outflows

- D . objectively determines if the proposal should be accepted or rejected.

Clark inc, expects to incur the following selected costs an a new product being planned for introduction early next.

✑ Design an development costs of $100,000 that will be incurred this year.

✑ Marketing costs of $50,000 to be incurred %50 this year %50 year

✑ Manufacturing costs of $500,000 to be incurred next year.

✑ In addition to external market factors, the pricing decision should be based on cost.

The product cost that should be used is

- A . $500,000

- B . $525, 000

- C . $550,000

- D . $650, 000

The best discount rate to the use for evaluate of investment opportunities is the

- A . opportunity cost of capital

- B . risk-free interest rate

- C . average market interest rate

- D . cost of the company’s debt

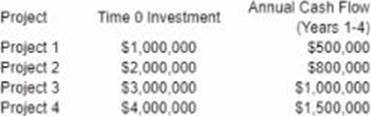

A corporation’s financial analyst has identified four potential protects that ate mutually exclusive. Each protect will produce a constant annual cash flow for years 1 through 4, and have an initial investment at time 0 shown below.

If the corporation has a weighted average cost of capital of 10%, which project should be selected?

- A . Protect 1

- B . Protect 2

- C . Protect 3

- D . Protect 4

Amy Curtin sells used cars of a reliable bona Curtin has no knowledge of me history or any or the specific cars She believes that the brand is reliable, and is considering whether it is acceptable to offer only this general Information rather than specific information regarding me cars when trying to complete each sale The company has always preferred to make the sale and worry about any warranty issues later and there are no legal disclosure requirements in their jurisdiction Curtin considers herself to be an ethical person but she does not want to lose out on any potential sales of vehicles that are most likely in good mechanical condition.

Which one of the following statements best represents what Curtin should consider related to the meaning of ethics?

- A . Ethics is driven by compliance with a set of regulations or laws

- B . Ethics is about being consistent with the ethical tone set by the organization

- C . Ethics is about the integrity of the decision making process to resolve issues

- D . Ethics is about decisions where the relevant policies are informal and not documented

An accountant is employed in the financial reporting department of a publicly-traded company. The company s compensation plan includes a year-end bonus based on the entity’s financial performance and stock option rewards based on individual performance Using iMAs Statement of Ethical Professional Practice, identify the ethical Issues, if any, that may Be presented by this company s compensation plan.

- A . The plan could threaten the accountant’s integrity

- B . The pan could threaten the accountant s competence

- C . The plan could threaten the accountant s credibility

- D . No significant potential threats are presented by the plan

Which one of the following situations describes a secondary offering of stock by a company?

- A . The company has an initial public offering of its stock and its investment bank needs to add mote shares to the initial public offering to meet excess demand by investors

- B . After the lockup period of the initial public offering ends, the company 3 founders sell some of their shares to the public

- C . The company repurchases shares of its stock in the open market, but it then later sells these shares in the open market

- D . After completing its initial public offering, the company sells more new shares of its stock

A furniture retail company uses the LIFO inventory method Due to the nigh inflation rate in me past year, the company’s

- A . current ratio may be overstated

- B . quick ratio may be understated

- C . net income may be understated

- D . quick ratio may be overstated

Which one of the following statements regarding working capital management is not correct?

- A . An attempt to minimize carrying costs and shortage costs associated with inventory levels is an objective of working capital management

- B . The cash, inventory accounts payable and accounts receivable components of working capital are constantly changing during the operating cycle

- C . Seasonal demand for me products can cause working capital problems that must De anticipated and managed

- D . Increasing costs associated with the manufacture and sale of products will not impact the short-term management of working capital

Latest CMA Strategic Financial Management Dumps Valid Version with 112 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund