IMA CMA Strategic Financial Management CMA Part 2: Strategic Financial Management Exam Online Training

IMA CMA Strategic Financial Management Online Training

The questions for CMA Strategic Financial Management were last updated at Dec 17,2025.

- Exam Code: CMA Strategic Financial Management

- Exam Name: CMA Part 2: Strategic Financial Management Exam

- Certification Provider: IMA

- Latest update: Dec 17,2025

Marsalls Products Inc. manufactures and sells two products CD-ROMs and DVD’s. The latest forecast on me products and their costs tor the coming year is shown in the following table.

Note 1: Fixed manufacturing cost of Si.500 000 per year is allocated to products based on the number of machine hours required to produce the product at a rate of S3 per machine

hour

The Manufacturing Team leader just informed the CEO that a fire occurred at one of the manufacturing lines and that line would be unavailable for the next 12 months. The result is that mere will only be 400 000 machine Hours available The CEO requested the management team to revise the plan for the coming year based on the new constraint. The Marketing Team leader stated that in order to minimize customer complaints about the shortage, a minimum of 100,000 units of each product should be produced With the new information from the Manufacturing and Marketing teams what is the optimal product mix for the coming 12 months” Assume Marsalls can sell allot its production.

- A . 100,000 CD-ROM’s and 150,000 DVD'[s

- B . 120.000 CD-ROM’s 140,000 DVD.

- C . 150.000 CD-ROMS and 125.000 DVD

- D . 200,000 CD-ROm’s a dn 100,000 DVD

Accounts receivable turnover increases from 4.0 times to 6.0 times.

It all sales are on account when one of the following must decrease?

- A . Cash

- B . Days sales in receivables

- C . Sales

- D . Accounts receivable

Employee performance review and development systems must be fully aligned with the requirements for ethical conduct Ethical expectations should be included in

- A . competencies, only

- B . job descriptions only

- C . competencies and job descriptions only

- D . compliances, job descriptions and objectives

Each of the following describes a limitation of financial statement analysis except

- A . financial statement analysis is based on historical costs rattier man current costs which can lead to distortions in measurement

- B . financial statements may include significant estimated items which may distort results

- C . it Is difficult to compare one company with another even within the same industry due to differences in accounting principles used.

- D . financial statement analysis can use more than one measure to examine the interrelationships among data

An organization s sol of values and code or ethics is an important consideration in human resource decisions for each of the following reasons except

- A . employees not motivated to adhere to a set of values may impact relationships wan other entities doing Business e organization.

- B . failure to address the alignment or individual values and ethics with organizational expectations may have a negative impact on performance.

- C . lack of a communicated set of values may create confusion and conflict among employees

- D . an organization may not have a legal right to discharge a dishonest employee if such a code is not communicated

SSA inc. issues 4% bonds with a lace value of $500,000 when the market rate of interest is 3% for similar bonds. The bonds mature in 10 years, and pay interest every six months.

Which one of the following is closest to the amount of cash SSA will receive upon issued.

- A . $459,000

- B . $500,000

- C . $505,000

- D . $543,000

The human resources manager of BankUS has noted mat me company s employee turnover has increased. He has also had his budget cut, and will have to reduce training for new associates. He has a meeting scheduled with the CFO lo go over risks that his department faces.

What should the human resources manager tell the CFO about risk?

- A . He should notify the CFO of a potential operations risk

- B . Me does not need to notify me CFO of a potential risk

- C . He should notify the CFO of a potential internal factor risk

- D . He should notify the CFO of a need for additional funding

A retail company sells numerous products m its one department store.

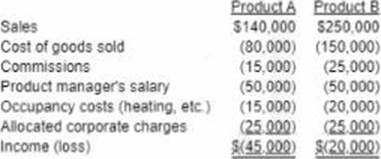

The income statements tot two of these products are shown below

After reviewing the income statements, the president is considering drooping one or both products.

Which produces), if any should the company discontinue?

- A . Both Product A and Product B

- B . Product A only

- C . Product B only

- D . Neither Product A nor Product B

Southwest Supplies Inc. (SSI) is considering the following two projects with cash-flows discounted at SSI’s weighted average cost of capital.

![]()

SSI can only afford to invest in one of the projects.

Which statement would most likely explain why SSI would choose Project B over project A?

- A . Project B results in a higher cumulative accounting income

- B . Project B generates significantly more non-cash expenses

- C . Project B cash-flows are relatively more certain

- D . Project B cash-flows are to be received sooner

An accountant for a company has not used readily available professional development opportunities to stay aware of changes in tax laws and applied previous tax rules to the most recent tax return, resulting in an overpayment of income tax Using IMA’s Statement of Ethical Professional Practice, how would the accountant’s behavior best be described?

- A . The accountant has complied with the competence standard if the lack of professional development is disclosed to supervisors

- B . The accountant has complied with the competence standard if the lack of professional development is disclosed in any reports or analyses the accountant produces

- C . The accountant has not complied with the credibility standard but has complied with the competence standard

- D . The accountant has not complied with the competence standard

Latest CMA Strategic Financial Management Dumps Valid Version with 112 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund