If his average tax rate is 40% and the investment return is 4%, how much life insurance should Jasper purchase based on the income replacement approach?

Jasper is the sole breadwinner in his family. His wife Stephanie has chosen to dedicate all of her time to raising their 3 young children. Luckily, Jasper earns a monthly after-tax income of $25,000 working as a family doctor in the local clinic. Jasper meets with his insurance agent Odda to purchase a life insurance policy that will ensure his family will be able to continue to enjoy their current lifestyle in the event of his death.

If his average tax rate is 40% and the investment return is 4%, how much life insurance should Jasper purchase based on the income replacement approach?

A . $625,000

B . $1,041,666

C . $7,500,000

D . $12,500,000

Answer: D

Explanation:

The income replacement approach calculates the amount of life insurance needed to replace Jasper’s after-tax income for his dependents over a given period, accounting for an investment return. To maintain the family’s current lifestyle, we need to determine the capital required to generate a monthly after-tax income of $25,000.

Calculate the Annual Income Needed:

Monthly income required: $25,000

Annual income required: $25,000 × 12 = $300,000

Adjust for Tax:

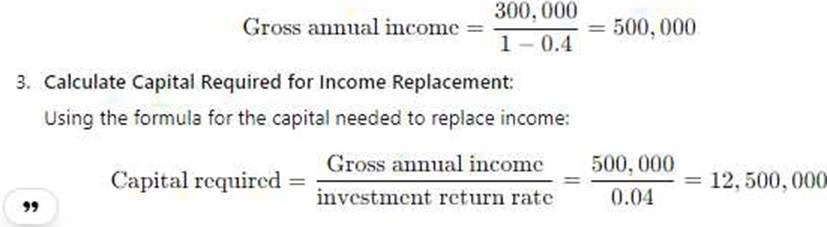

Since Jasper’s income needs to be replaced at a pre-tax level with a tax rate of 40%, his gross income requirement is calculated as follows:

Thus, Jasper needs a life insurance policy worth $12,500,000 to replace his income, allowing his family to maintain their lifestyle with a 4% investment return. This calculation aligns with LLQP principles, ensuring that the income replacement fully addresses both current lifestyle needs and tax implications.

Latest LLQP Dumps Valid Version with 150 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund