APA CPP-Remote Certified Payroll Professional Online Training

APA CPP-Remote Online Training

The questions for CPP-Remote were last updated at Feb 20,2026.

- Exam Code: CPP-Remote

- Exam Name: Certified Payroll Professional

- Certification Provider: APA

- Latest update: Feb 20,2026

Which of the following accounts has a normal debit balance?

- A . Liability

- B . Expense

- C . Revenue

- D . Equity

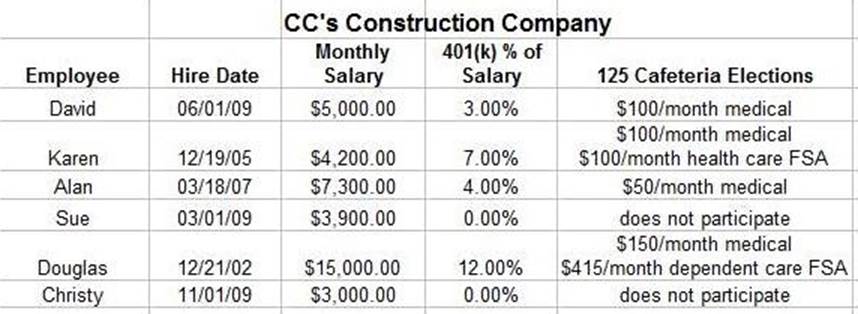

What is the amount reported in box 12, and what code is used?

- A . C 4,980

- B . D 24,582

- C . C 10,480

- D . D 29,682

Which of the following would not be included in the Needs Analysis stage of a system evaluation?

- A . Review of the current system

- B . Creating a current cost model

- C . Defining the company’s technical direction

- D . System testing

Which of the following is not likely to be included in payroll documentation?

- A . Auditors’ Questionnaire

- B . Proofing and Balancing Payroll

- C . Tax Set Up

- D . Correcting Errors

Which of the following is the most logical order of events in a system implementation?

- A . Training, development, testing evaluation

- B . Feasibility, evaluation, development, testing

- C . Conversation, training, testing, evaluation

- D . Testing, evaluation, training, documentation

Which for the following statements is true?

- A . A company’s fiscal year must not be the same as the calendar year

- B . A company’s fiscal year must be the same as the calendar year

- C . A company may designate its fiscal year to cover 12 months that differ from the calendar year

- D . A company must produce Forms W-2 at the end of its fiscal year regardless of the calendar

With regard to employee’s reported tips, the employer must:

- A . report tips as wages on Form W-2 and pay the employer portions of social security and Medicare taxes

- B . report taxes on tips separately when making an employment tax deposit

- C . report and pay the employer portion of social security and Medicare taxes on the portion of cash tips above the federal minimum wage

- D . withholds and pays only the employees’ portion of social security and Medicare taxes on tips

What is one of the major considerations when evaluating and selecting a software system for payroll?

- A . The sale’s representative’s knowledge of payroll

- B . The arrangement of the panels for on-line data entry

- C . The number of trainers the software has available

- D . The fit of the technical platform with the company’s strategic plans

The rate of withholding in 2009 on qualified pension distributions made directly to

employees is:

- A . 15%

- B . 20%

- C . 27%

- D . 30%

An employee earns $9 per hour and an additional 10 cents per hour for hours worked after 7:00 p.m.

If an employee works from 3:00 p.m. to 11:00 p.m., Monday through Friday, what is the employee’s weekly gross pay under the Fair Labor Standards Act?

- A . $360

- B . $362

- C . $364

- D . $361

Latest CPP-Remote Dumps Valid Version with 249 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund