APA CPP-Remote Certified Payroll Professional Online Training

APA CPP-Remote Online Training

The questions for CPP-Remote were last updated at Jul 17,2025.

- Exam Code: CPP-Remote

- Exam Name: Certified Payroll Professional

- Certification Provider: APA

- Latest update: Jul 17,2025

Which of the following general ledger accounts is integral to a quarterly deposit reconciliation?

- A . Accrued wages payable

- B . Salary cash

- C . Tax liabilities

- D . Payroll cash

Assuming that the moving expense was incurred in 2009, which of the following expense reimbursements is excludable from gross income?

- A . Travel expenses of spouse to search for new residence at new job location

- B . Mileage for a pre-move house hunting trip

- C . Lodging expenses while waiting for the new home to be built

- D . Mileage while moving from the old residence to the new

When the state does not allow workers’ compensation converge through a private insurance carrier, this is referred to as a:

- A . Public fund state

- B . National council state

- C . Competitive state

- D . Monopolistic state

Bass Biting Company operates bait, tackle and boat sales store employing 12 full time clerks and salespeople in addition to the owner and his family members. Occasionally, Bass Biting assigns special work to individuals other than its regular employees and family members. Employee Lois was a bait and tackle shop clerk until she retired on June 30. Lois returned to the bait and tackle shop to perform clerical duties on August 15 and worked through Labor Day to assist Bass Biting through its busy season. Determine Lois’ employment status with Bass Biting

- A . Statutory nonemployee

- B . Independent contractor

- C . Nonstatutory employee

- D . Employee

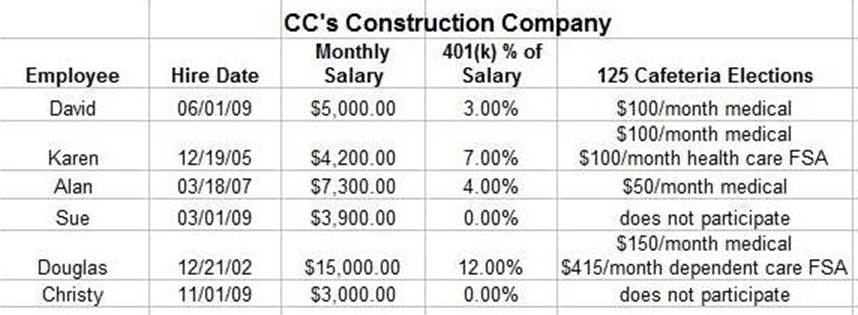

What is the total amount reported in box 10, "Dependent care benefits?"

- A . $ 0

- B . $10,480

- C . $5,500

- D . $4,980

Which of the following describes a plan involving the entire organization for carrying on a company’s business in the event of a major disaster?

- A . Groupware

- B . Implementation plan

- C . Production plan

- D . Business continuity

Jane voluntarily separated from employment. She is allowed to continue paying for her medical insurance at cost plus 2% under what legislation?

- A . Fair Labor Standards Act of 1948

- B . Family and Medical Leave Act of 1993

- C . Tax Reform Act of 1986

- D . Consolidated Omnibus Budget Reconciliation Act of 1985

Which of the following best represents compliance under Section 404 of Sarbanes Oxley?

- A . Payroll transactions are reviewed by internal audit

- B . Service provider initiates all pay transactions

- C . Accruals entries are made by the payroll staff

- D . Benefits enrollment data is maintained by authorized personnel

Which of the following agencies would most likely enforce rules governing the number of days following the close of the payroll period that employees must be paid?

- A . State workers’ compensation board

- B . State labor department

- C . Internal Revenue Service

- D . Social Security Administration

In the context of fringe benefits, the term "discriminatory plan" refers to a plan that disproportionately favors:

- A . An ethnic group

- B . An age group

- C . A sex

- D . The highly paid

Latest CPP-Remote Dumps Valid Version with 249 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund