AAFM GLO_CWM_LVL_1 Chartered Wealth Manager (CWM) Global Examination Online Training

AAFM GLO_CWM_LVL_1 Online Training

The questions for GLO_CWM_LVL_1 were last updated at May 10,2025.

- Exam Code: GLO_CWM_LVL_1

- Exam Name: Chartered Wealth Manager (CWM) Global Examination

- Certification Provider: AAFM

- Latest update: May 10,2025

Merton’s theory is ___________

- A . Of continuous time finance

- B . a link from Arrow-Debreu world to real world

- C . about dynamic replication

- D . All of the above

Which of the following is not a business risk?

- A . Change of business cycles

- B . Change in Government policy

- C . Change in Government Law which affecting a particular industry

- D . Changes in Interest Rate

According to the capital asset pricing model, the expected rate of return on any security is equal to __________.

- A . [(the risk-free rate) + (beta of the security)] x (market risk premium)

- B . (the risk-free rate) + [(variance of the security’s return) x (market risk premium)]

- C . (the risk-free rate) + [(security’s beta) x (market risk premium)]

- D . (market rate of return) + (the risk-free rate)]

Multi period hedging is ________

- A . A way to manage qualitative risk over time

- B . A way to manage market risk over time

- C . A way to manage sentimental risk over time

- D . None of the above

What is the minimum paid up capital needed to form a public limited company?

- A . No Minimum requirement

- B . Rs. 100000

- C . Rs. 500000

- D . Rs. 1000000

For a “single income family” priority is on

- A . Protecting income via a term plan

- B . Investing in commodities to grow wealth

- C . Investing in Mutual Funds to grow wealth

- D . None of the above

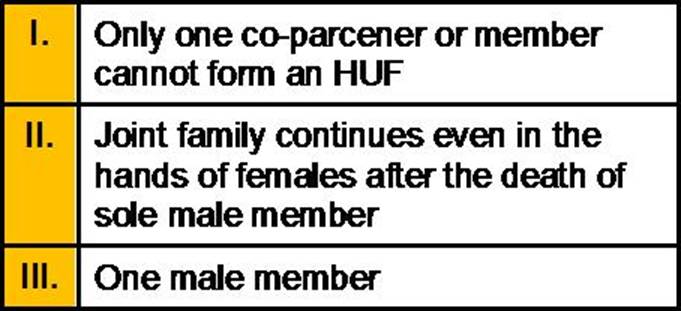

Which of the following are the basic requirements for an existence of an HUF?

- A . Only I and II

- B . Only II and III

- C . All of these

- D . Only I and III

If any expenditure is incurred by an Indian company wholly and exclusively for the purpose of amalgamation or demerger, the said expenditure is

- A . Not allowable as a deduction in computing profits and gains of business or profession

- B . Allowed as a deduction spread over five successive previous year beginning with the previous year in which the amalgamation or demerger takes place

- C . Not deductible but is eligible to be treated as an intangible asset in respect of which depreciation can be claimed

- D . Fully deductible as revenue expenditure in the year in which it is incurred.

Government has changed certain industries related regulation in Parliament, it is an example of:

- A . Interest rate risk

- B . Political risk

- C . Market risk

- D . None of the above

IFSC stands for:

- A . Inter-bank Financial Sector Code

- B . Inter-bank Funds Settlement code

- C . Inter-bank Financial Service Code

- D . None of the above

Latest GLO_CWM_LVL_1 Dumps Valid Version with 1057 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund