AAFM CWM_LEVEL_2 Chartered Wealth Manager (CWM) Certification Level II Examination Online Training

AAFM CWM_LEVEL_2 Online Training

The questions for CWM_LEVEL_2 were last updated at Dec 05,2025.

- Exam Code: CWM_LEVEL_2

- Exam Name: Chartered Wealth Manager (CWM) Certification Level II Examination

- Certification Provider: AAFM

- Latest update: Dec 05,2025

Section A (1 Mark)

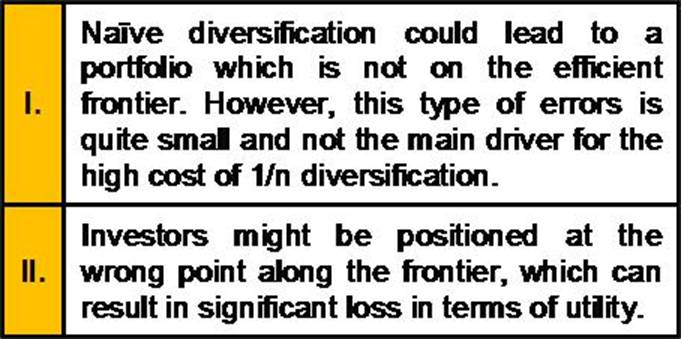

Which of the following statements is/are correct with respect to naïve diversification?

- A . Only I

- B . Only II

- C . Both of the above

- D . None of the Above

Section B (2 Mark)

Any income chargeable under the based “Salaries” is exempt from tax under Section 10(6)(viii), if it is received by any non resident individual as remuneration for services rendered in connection with his employment in a foreign ship where his total stay in India does not exceed a period days in that previous year.

- A . 90

- B . 182

- C . 60

- D . 120

Section C (4 Mark)

Read the senario and answer to the question.

Jogen commuted his 40% of pension in April, 2008 with Rs. 2,15,000.

What would be the taxable amount on commuted pension received by Jogen, if he would retire from a private organization?

- A . Rs. 1,07,500

- B . Rs. 35,833

- C . Rs. 1,70,167

- D . Rs. Nil

Section B (2 Mark)

Which of the following statements is most correct?

- A . If a company increases its current liabilities by Rs1,000 and simultaneously increases its inventories by Rs1,000, its current ratio must rise.

- B . If a company increases its current liabilities by Rs1,000 and simultaneously increases its inventories by Rs1,000, its quick ratio must fall.

- C . A company’s quick ratio may never exceed its current ratio.

- D . Answers b and c are correct.

Section B (2 Mark)

Withholding Tax Rates for payments made to Non-Residents are determined by the Finance Act passed by the Parliament for various years.

The current rates for Royalities are:

- A . 10

- B . 15

- C . 20

- D . 18

Section A (1 Mark)

In a short call, profit is

- A . Unlimited

- B . Limited to premium

- C . Premium Plus Market Price minus exercise price

- D . Premium minus exercise price

Section A (1 Mark)

Unabsorbed depreciation can be carried forward for ____________.

- A . 8 Years

- B . 4 Years

- C . Indefinite

- D . None

Section C (4 Mark)

Pizer Drugs, a large drugstore chain, had sales per share of Rs122 in 1993, on which it reported earnings per share of Rs2.45 and paid a dividend per share of Rs1.12. The company is expected to grow 6% in the long term, and has a beta of 0.90. The current Risk Free Rate is 7%.

Estimate the appropriate Price for Pizer Drug and what would the profit margin need to be to justify the price per share if the stock is currently trading for Rs34 per share, assuming the growth rate is estimated correctly,

- A . Rs20.18 and 4.12%

- B . Rs 21.05 and 5.25%

- C . Rs 19.87 and 3.42%

- D . Rs 18.54 and 3.75%

Section B (2 Mark)

The _________ is a plot of __________.

- A . CML, individual stocks and efficient portfolios

- B . CML and both efficient and inefficient portfolios, only

- C . SML and individual securities and efficient portfolios

- D . SML and individual securities, inefficient portfolios, and efficient portfolios.

Section A (1 Mark)

Rahul deposits Rs. 30,000/- per year, at the end of the year, into an account for 30 years.

What amount would be accumulated in that account at the end of 30 years if ROI is 9 % per annum?

- A . 3498723.56

- B . 4089226.15

- C . 2345226.34

- D . 4298712.9

Latest CWM_LEVEL_2 Dumps Valid Version with 1259 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund