AAFM CWM_LEVEL_2 Chartered Wealth Manager (CWM) Certification Level II Examination Online Training

AAFM CWM_LEVEL_2 Online Training

The questions for CWM_LEVEL_2 were last updated at Dec 05,2025.

- Exam Code: CWM_LEVEL_2

- Exam Name: Chartered Wealth Manager (CWM) Certification Level II Examination

- Certification Provider: AAFM

- Latest update: Dec 05,2025

Section C (4 Mark)

Read the senario and answer to the question.

Mr. Bhatia is interested to invest in a mutual fund SIP account and expecting which will grow by atleast 12% for Neena’s education need. Calculate how much he has to deposit per month?

- A . Rs. 12,952

- B . Rs. 14,956

- C . Rs. 15,913

- D . Rs. 16,946

Section A (1 Mark)

Response of listening falls under which one of the following categories?

- A . It can be verbal

- B . It can be nonverbal

- C . It can be verbal or nonverbal

- D . It can neither be verbal nor nonverbal

Section C (4 Mark)

Read the senario and answer to the question.

Mr. Bhatia owns a Maruti Wagonr with a monthly EMI of Rs. 6,312. The above loan will be completely repaid by August 2008. Mr. Bhatia planning to purchase a new car worth of Rs. 15 lakh. For this he has to take a full value loan of the car with 9% interest for 5 years. But his present car is in good condition and life of this car is approximately another 5 years repairs and maintenance cost are minimum. If he postpones his car purchasing plan now and deposit the same EMI outflow required for new car into an SIP with a minimum 15% yield for the next five years, then calculate the fund he can accumulate?

- A . Rs. 23.66 lacs

- B . Rs. 27.58 lacs

- C . Rs. 23.49 lacs

- D . Rs. 30.47 lacs

Section B (2 Mark)

Which of the following is an inferential data (i.e. data which may not be correctly obtained by simply asking a direct question)?

- A . Time Horizon

- B . Risk appetite

- C . Current Income

- D . Future income requirement

Section A (1 Mark)

If a portfolio manager consistently obtains a high Sharpe measure, the manager’s forecasting ability __________.

- A . is above average

- B . is average

- C . is below average

- D . None of the Above

Section C (4 Mark)

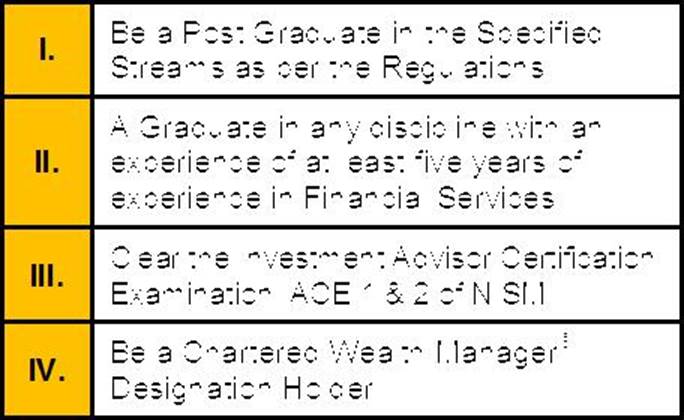

To fulfil the Educational Qualification to be registered as an Investment Advisor under the SEBI Investment Advisor Regulations 2013.

The applicant must:

- A . Both I and IV

- B . Both II and III

- C . Either of I or II and Either of III or IV

- D . All I, II, III and IV

Section B (2 Mark)

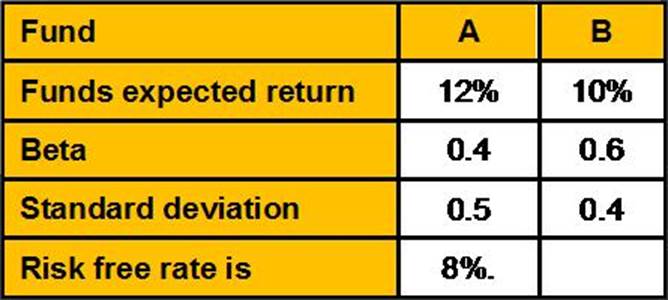

The following parameters are available for two mutual funds:

Calculate Treynor’s performance index for Fund A & Fund B respectively

- A . 8, 1.66

- B . 10, 3.33

- C . 9, 2.50

- D . 18, 4.25

Section C (4 Mark)

Read the senario and answer to the question.

If Mahesh has the option of 3 funds whose details are as below, find Jensen’s index for fund A, Treynor index for fund B and Sharpe index for the market

- A . 0.7%; 2.2; 0.1764

- B . 0.5%; 2.2; 0.1764

- C . 1%; 2.2; 0.5

- D . 1%; 2.2; 0.8

Section A (1 Mark)

_____________allow investors to increase diversification in direct real estate holdings by investing in groups of real estate projects.

- A . Lease / Tenancy Agreement

- B . Aggregation Vehicles

- C . High and Best Use of Property

- D . Leveraged Equity Position

Section B (2 Mark)

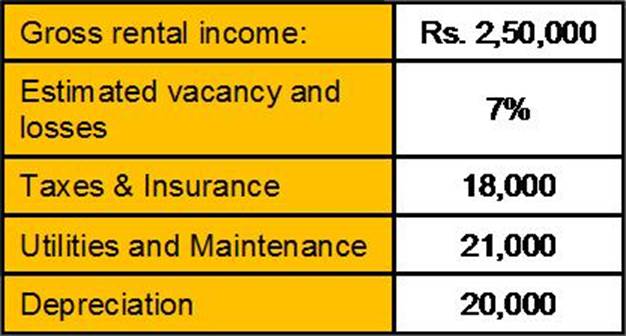

Calculate the NOI for an office building with the following information:

- A . Rs. 1,73,500

- B . Rs. 1, 91,000

- C . Rs. 1,93,500

- D . Rs. 2,11,000

Latest CWM_LEVEL_2 Dumps Valid Version with 1259 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund