AAFM CWM_LEVEL_2 Chartered Wealth Manager (CWM) Certification Level II Examination Online Training

AAFM CWM_LEVEL_2 Online Training

The questions for CWM_LEVEL_2 were last updated at Dec 05,2025.

- Exam Code: CWM_LEVEL_2

- Exam Name: Chartered Wealth Manager (CWM) Certification Level II Examination

- Certification Provider: AAFM

- Latest update: Dec 05,2025

Section A (1 Mark)

The steps to establishing an investment policy are to state the Pass Your Certification With Marks4sure Guarantee

- A . Minimum investment and maximum fees.

- B . Regulatory guidelines for prudent man investing.

- C . Objectives and constraints and preferences.

- D . Asset allocation parameters and time horizons.

Section A (1 Mark)

Every employer is obliged to ensure that his employees get a safe and secure workplace. In relation to the risks arising in the workplace which affects the employees, cover is provided through

- A . Employees’ Provident fund

- B . Workmen’s compensation insurance

- C . Employees’ group life insurance

- D . Employees’ personal accidents insurance scheme

Section B (2 Mark)

As per article 12 Double Taxation Avoidance Agreement with Singapore, Royalties and fees for technical services arising in a Contracting State and paid to a resident of the other Contracting State may be taxed in that other State. However, such royalties and fees for technical services may also be taxed in the Contracting State in which they arise and according to the laws of that Contracting State, but if the recipient is the beneficial owner of the royalties or fees for technical services, the tax so charged shall not exceed__________ per cent.

- A . 10

- B . 15

- C . 20

- D . 12

Section C (4 Mark)

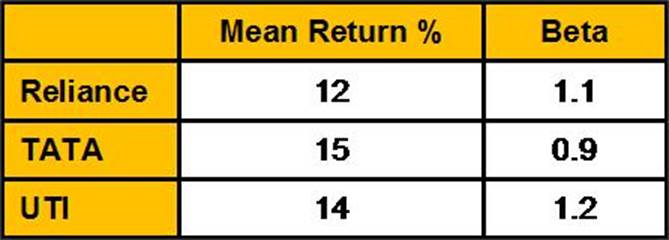

Consider the following information for three mutual funds:

Market Return 10%

Risk free return is 7%.

Calculate Jensen measure (%).

- A . 1.70, 5.30, 3.40

- B . 2.25, 3.78, 4.65

- C . 4.35, 3.78, 2.53

- D . 3.17, 4.58, 5.78

Section A (1 Mark)

Which one of the following statements is incorrect?

- A . Most hedge fund managers do not have to explain their investment decisions to investors

- B . A hedge fund side pocket prevents the redemption of certain investments which might be difficult to value

- C . Lock-ups in hedge funds prevent the manager from selling any of his investments without express permission from investors

- D . Gates placed on hedge funds limit the amount that can be withdrawn from it in anyone year

Section A (1 Mark)

Deduction under section 80QQB is allowed in respect of royalty income to:

- A . an individual who is an author of a book

- B . an individual who is resident in India and who is an author of a book

- C . an individual who is resident in India who is either an author of a book or a joint author of the book

- D . None of the Above

Section A (1 Mark)

A muslim gentleman can leave his will, bequeathing all his properties to someone often than his legal heirs to the extent of…………….

- A . His wish

- B . A small portion

- C . One third

- D . One half

Section B (2 Mark)

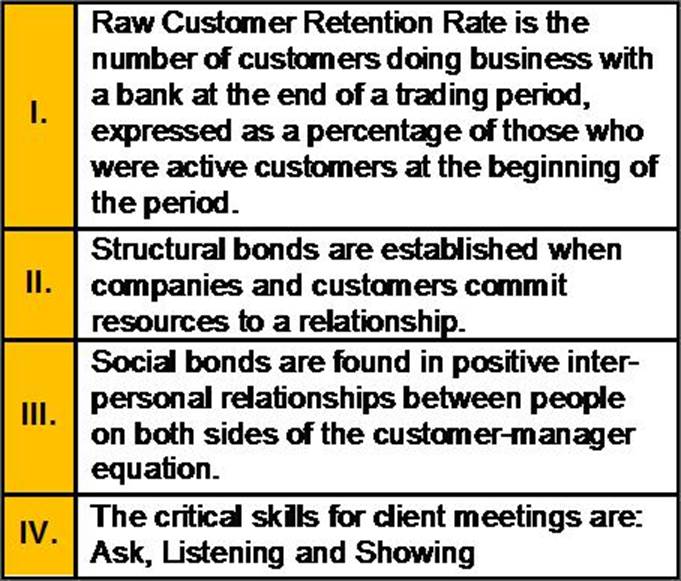

Which of the following statements is / are correct?

- A . I, II and III

- B . I, III and IV

- C . II, III and IV

- D . All of the above

Section A (1 Mark)

Mr. Rajesh was the owner of an uninsured property. But unfortunately the property caught fire because of which he suffered severe financial losses.

The reason Mr. Rajesh suffered losses as he did not cover:

- A . The investment risk

- B . The pure risk

- C . The speculative risk

- D . The dynamic risk

Section C (4 Mark)

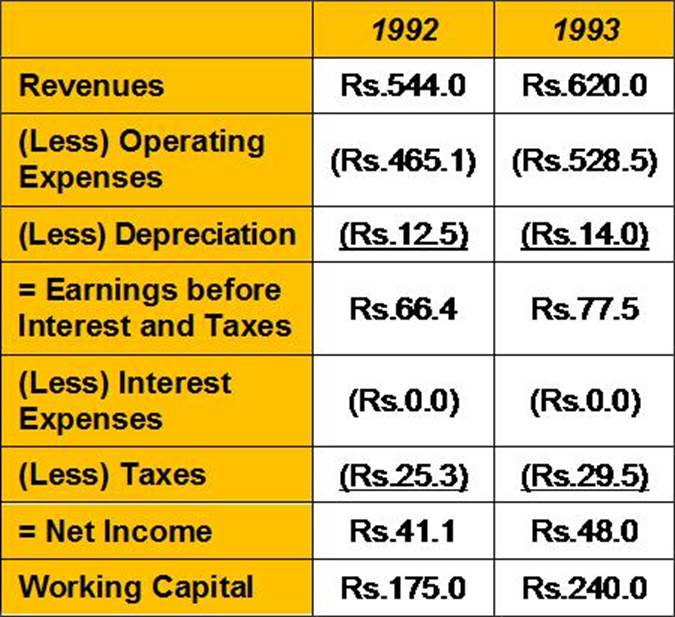

Dab Ltd manufactures, markets, and services automated teller machines.

The following are selected numbers from the financial statements for 1992 and 1993 (in millions):

The firm had capital expenditures of Rs15 million in 1992 and Rs18 million in 1993. The working capital in 1991 was Rs180 million.

Estimate the cash flows to equity in 1992 and 1993. (in Rs Millions)

- A . 45 and (20.5)

- B . 43.60 and (21)

- C . 76 and 19.55

- D . 102 and 301

Latest CWM_LEVEL_2 Dumps Valid Version with 1259 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund