AAFM CWM_LEVEL_2 Chartered Wealth Manager (CWM) Certification Level II Examination Online Training

AAFM CWM_LEVEL_2 Online Training

The questions for CWM_LEVEL_2 were last updated at Dec 17,2025.

- Exam Code: CWM_LEVEL_2

- Exam Name: Chartered Wealth Manager (CWM) Certification Level II Examination

- Certification Provider: AAFM

- Latest update: Dec 17,2025

Section A (1 Mark)

Which of the following is true regarding the resistance level?

- A . Resistance levels tend to develop due to profit taking.

- B . It is the level at which a significant decrease in demand is expected.

- C . It is the level at which a significant increase in supply is expected.

- D . Resistance levels usually develop after a stock reaches a new low.

Section A (1 Mark)

Endorsements modify

- A . Life & Health Insurance contracts

- B . Property & Liability Insurance contracts

- C . Both of the above

- D . None of the above

Section B (2 Mark)

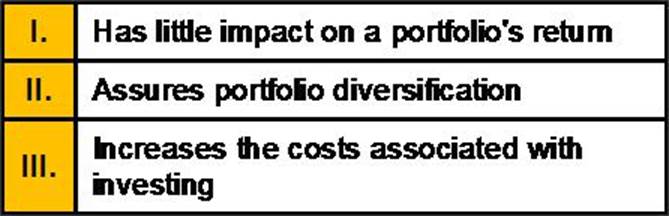

Asset allocation policy

- A . I and II

- B . I and III

- C . II and III

- D . None of the above

Section A (1 Mark)

The difference between the cash price and the futures price on the same asset or commodity is known as the

- A . Basis

- B . Spread

- C . Yield spread

- D . Premium

Section C (4 Mark)

Puspinder Singh Ahluwalia took a housing loan on 1st. of June 2009 (EMI in arrear) of Rs. 50 lacs at a ROI of 10.75% p.a. compounded monthly for 12 years. He wants to know the deduction in taxable income he can claim u/s 24 of the IT act for the FY 2011 -12

- A . 480178

- B . 150000

- C . 330178

- D . 125000

Section A (1 Mark)

In US which group is unlikely to support tax limitations?

- A . People who benefit from government spending

- B . People whose tax burdens are heaviest

- C . People who think government wastes a lot of money

- D . Conservatives and Republicans

Section B (2 Mark)

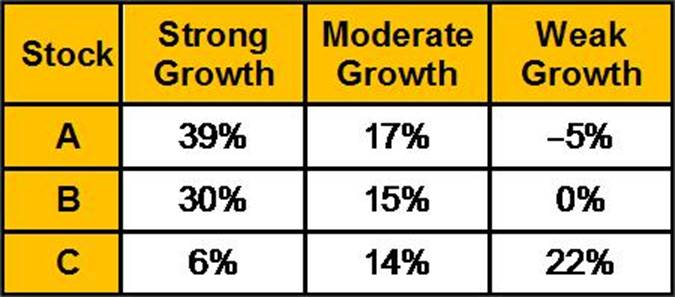

There are three stocks, A, B, and

C. You can either invest in these stocks or short sell them. There are three possible states of nature for economic growth in the upcoming year; economic growth may be strong, moderate, or weak.

The returns for the upcoming year on stocks A, B, and C for each of these states of nature are given below:

If you invested in an equally weighted portfolio of stocks A and B, your portfolio return would be ___________ if economic growth were moderate.

- A . 3.00%

- B . 14.50%

- C . 15.50%

- D . 16.00%

Section B (2 Mark)

As a CWM you are considering the following bond for inclusion in the fixed income portfolio of your client:

What will be the duration of this bond? and What will be the effect of the changes on the duration of the bond if the coupon rate is 6% rather than 9%?

- A . 8 years, Increase

- B . 7.33 years, Decrease

- C . 6.031 years, Increase

- D . 7.012 Years, Decrease

Section A (1 Mark)

For claiming exemption u/s 54G, the assessed shall acquire the new asset within:

- A . 2 years from the date of transfer

- B . 3 years from the date of transfer

- C . one year before or 2 years after the date of transfer

- D . one year before or 3 years from the date of transfer

Section A (1 Mark)

Manav saves Rs. 20,000/- a year for 5 years and Rs. 30,000/- a year for 10 years thereafter.

What will be the total amount in his account after 15 years, if ROI is 10 % per annum?

- A . 784823.87

- B . 694823.87

- C . 894823.87

- D . 794823.87

Latest CWM_LEVEL_2 Dumps Valid Version with 1259 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund