AAFM CTEP Chartered Trust & Estate Planner® (CTEP®) Certification Examination Online Training

AAFM CTEP Online Training

The questions for CTEP were last updated at Dec 05,2025.

- Exam Code: CTEP

- Exam Name: Chartered Trust & Estate Planner® (CTEP®) Certification Examination

- Certification Provider: AAFM

- Latest update: Dec 05,2025

You are an Estate Planner. Mr. Arun Mittal, a HNI client asks you to explain him the number of ways to dispose of his wealth. You explain to him about the three ways of disposing wealth. He further asks you to give ranking to the methods-from most preferred to least preferred. You tell Mr. Arun that the correct order is _________________.

- A . Consumption, Inheritance, Philanthropy

- B . Inheritance, Consumption, Philanthropy

- C . Philanthropy, Inheritance, Consumption

- D . None as he can dispose his wealth in any order.

In context to Workmen’s Compensation Act, any claim for the compensation should be made within _________ of the occurrence of the accident or from the date of death.

- A . 6 months

- B . 10 months

- C . 1 year

- D . 2 years

More than_______ in wealth classifies the person as “Ultra HNI”

- A . $1 million

- B . $10 million

- C . $50 million

- D . $100 million

According to ___________ of the Registration Act, 1908 the registration of a Will is not compulsory. A suit can only be filed within ___________days after the refusal of registration by the Registrar. An oral will made by a soldier above 18 years of age will be valid for __________ while a written will be valid for ___________.

- A . Section 18, 30, One month, Forever

- B . Section 18,15, One Month, Three Months

- C . Section 8, 15, One Month, Forever

- D . Section 8, 30, One Month, Forever

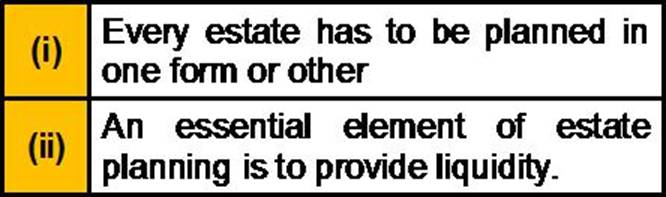

Which of the following statement is true?

- A . Only (i)

- B . Only (ii)

- C . Both (i) and (ii)

- D . Neither (i) nor (ii)

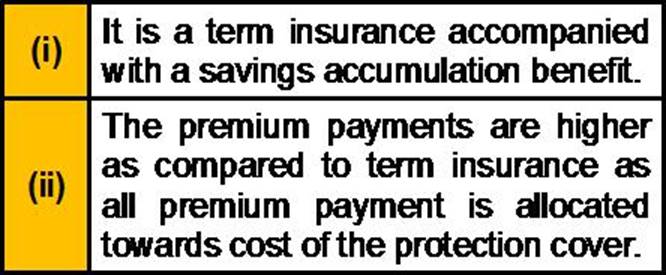

Which of the following statement(s) about ‘Whole Life Insurance’ is/are correct?

- A . Both (i) and (ii)

- B . Only(i)

- C . Only (ii)

- D . Neither (i) nor (ii)

Private Companies have a minimum paid up capital of _______________ or such higher capital as may be prescribed.

- A . Rs 1,00,000

- B . Rs.3,00,000

- C . Rs.5,00,000

- D . Rs10,00,000

As per Payment of Gratuity Act, Gratuity shall be payable to an employee after he has rendered continuous service for not less than __________

- A . 2 years

- B . 5 years

- C . 10 years

- D . 15 years

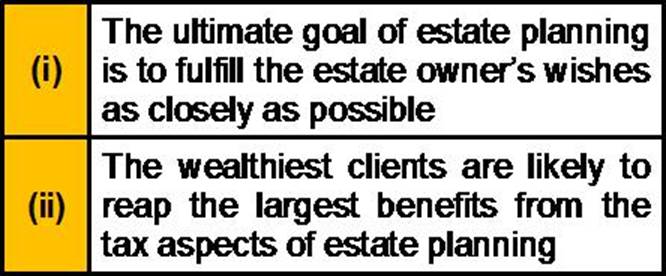

Which of the following statement(s) about Estate Planning is/are true?

- A . Neither (i) nor (ii)

- B . Both (i) and (ii)

- C . Only(i)

- D . Only (ii)

Latest CTEP Dumps Valid Version with 472 Q&As

Latest And Valid Q&A | Instant Download | Once Fail, Full Refund